Leadership through knowledge

Take a deep dive into the rapidly changing world of e-commerce and fintech.

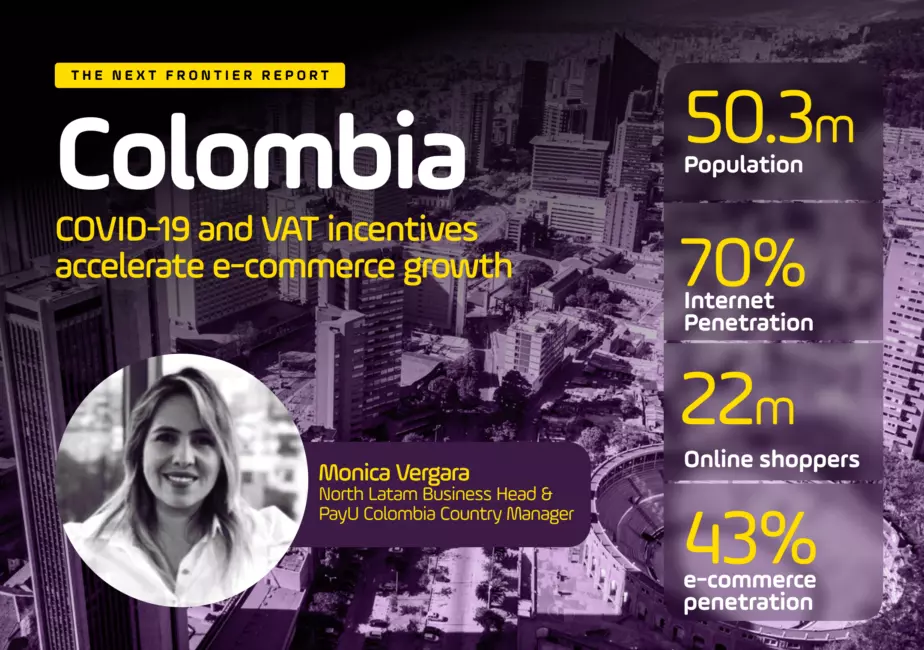

Visit Insights overviewPayU North LatAm Business Head Monica Vergara talks about some of the factors driving the growth of e-commerce in one of South America’s key markets. 11/08/2021

2020 changed everything in Colombia. Prior to the pandemic, e-commerce in Latin America was already growing by 20% year-on-year and was on course to reach a value of USD $187 billion by 2021. And that was before e-commerce penetration doubled across the region during just the first week of last year’s initial lockdowns. Between the Spring and Summer of 2020, the number of e-commerce customers making payments on PayU’s Latin American platforms nearly doubled as well, from 5.1 per month in February to 8.9 million by July.

But while COVID-19 may have caused a short-term surge, the consumer migration towards e-commerce in Colombia and across Latin America is a long-term trend. By 2025 there will be 424 million mobile internet users in Latin America, which will grow the sector even further.

Colombia is South America’s second-largest country by population and a country that has long been the cornerstone of PayU’s local presence in Latin America. So what are the market drivers, challenges, and opportunities for e-commerce in one of LatAm’s key growth markets?

As part of The Next Frontier, PayU’s recent report on e-commerce opportunities in emerging markets, we reached out to Monica Vergara, North LatAm Business Head and Colombia Country Manager for PayU, to share her thoughts on the present and future of Colombian e-commerce.

Scroll below to read Monica’s responses and be sure to check out our other recent conversations with leaders in some of the world’s top emerging e-commerce markets.

With the arrival of the pandemic last Spring, the ideas we had about business changed completely. Even large companies had to “reinvent” themselves. Many companies had to migrate their physical business model to online overnight and others duplicated their online operations. The challenge wasn’t only for the merchants, but for the whole ecosystem. With e-commerce shopping volumes on our PayU Colombia platform growing by a total of 54% year-over-year by the end of 2020, our technical teams spent a lot of time making sure our systems could handle the increases in transaction load, in addition to the operational and commercial support that this requires.

In recent years, a number of governments in Latin America set financial inclusion goals as one of their most important objectives. Colombia set a goal to reach 85% financial inclusion by 2022. In part due to COVID-19, this goal was met and exceeded two years ahead of schedule during 2020, with financial inclusion reaching 85.9% during the year.

Quantifying these percentages, during the quarantine months, 1.6 million adults in Colombia obtained some financial product for the first time and 2.3 million reactivated the one they already had. Colombia currently leads the financial inclusion ranking in our region, above Peru, Uruguay, Argentina and Mexico.

In addition to this important point, the actions of the banks that granted grace periods to cardholders, lower rates and new payment agreements stand out and helped in the results for e-commerce in the country, which has been a lifesaver for the economy as a whole.

The biggest factor for e-commerce in Colombia last year was the government’s decision to create three tax-free shopping holidays during the year on June 19, July 3 and November 21. For the last two dates, these tax-free discounts only applied to online purchases.

During the three days PayU processed a total of USD $243 million in Colombia (an average of $81 million on each day), compared to the USD $16 million we average on a normal day. The tax-free initiative was focused on economic reactivation across multiple sectors, with PayU emerging as a key voice within the local e-commerce community during this time.

PayU’s vision is to create a world without financial borders where everyone can prosper. Our role as a leading global voice on this topic is to help people, business, and stakeholders in between to make the link between access to financial services and increased prosperity. Colombia is a key market for PayU and we truly believe that our investment in financial education will bring more business opportunities to our customers and citizens in general.

One factor in increasing access to financial services is doing a better job of expanding digital access. According to our own research, by 2025 three out of four Latin Americans will have at least one mobile service line. But for now, in 2021, our challenge is to reach those new users and to understand their needs, their dynamic and built their confidence in the security that online payments and digital financial products in general.

Experiences that connect financial solutions with convenience and lower costs will have a high chance of acceptance and success, but unfortunately in our country high costs and the impact in families’ economy is still a problem to be solved. By helping to lower costs and expand access, I truly believe that fintechs are playing an important role in the overall development of Latin America.

One of the biggest opportunity for e-commerce in Colombia is related to the recent opening up of the payment systems landscape. This allows users to access to different payments services providers, which will improve accessibility with the participation of new market actors.

Additionally, there is discussion of opening up payment acquiring to credit institutions and companies based outside of Colombia. This too will increase competition in the payment ecosystem which will help to lower costs and benefit final consumers as well.

The macroeconomic outlook continues to be uncertain, but this contributed to Colombian buyers increasingly opening to the benefits of digital financial services, and to online consumption in general. In the last 3 years alone the LatAm region as a whole has doubled its ecommerce revenues. On this subject we see a good opportunity to further improve mobile payments capability via our mPOS tool, which will improve our offering for small entrepreneurs and merchants.

A key aspect in the overall growth of e-commerce all across Latin America has been the security and trust that brands and payment gateways have been able to generate. In the past, the main demotivating factor about online shopping in our region was the fear of suffering an identity theft from having to enter credit card credentials. That’s why at PayU we are always working with AI and machine learning on our anti-fraud module which is recognized for being an in-house development that allows us to constantly evaluate our processing monitoring rules to keep electronic fraud levels even lower than in other payment gateways.

Get further insights on the e-commerce landscape across Romania and nearly 20 other emerging e-commerce markets where PayU operates around the world.

Combining external sources with local data directly from PayU’s payments platform, our report also provides a window into the payment ecosystem across the countries surveyed, leveraging our experience as a leading payment technology platform offering merchants a single global solution for emerging as well as established markets.

Fill in the form to download our report and learn more about the fast-moving digital landscape in some of the world’s most exciting growth markets for e-commerce.