Leadership through knowledge

Take a deep dive into the rapidly changing world of e-commerce and fintech.

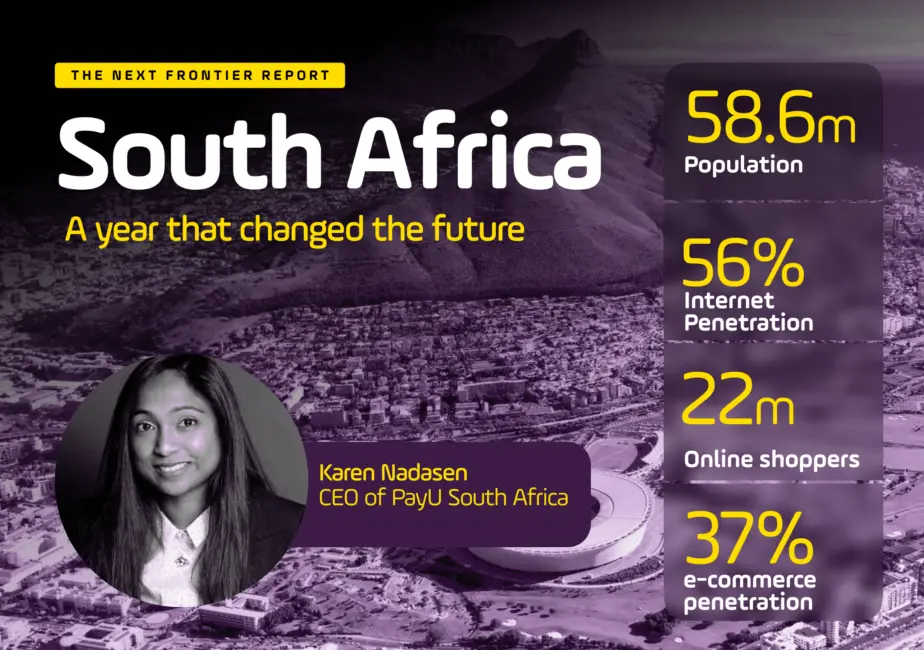

Visit resource hubInsights from PayU Country Manager Karen Nadasen on a year that changed the future for South African e-commerce.

2020 was a year of reckoning: a year that lit a fire beneath online payments in South Africa, transforming e-commerce while creating immense economic pressure.

As the global pandemic waged war on government processes, merchant sales and consumer behavior, companies were faced with tough decisions and mercurial markets that reshaped how they worked, innovated and delivered services.

How has the pandemic impacted e-commerce and online payments in South Africa? And what are the challenges and opportunities going forward? As part of The Next Frontier, PayU’s recent report on e-commerce opportunities in emerging markets, we reached out to Karen Nadasen, Country Manager for PayU South Africa, to share her thoughts on the present and future of South African e-commerce.

Scroll below to read Karen’s responses and be sure to check out our other recent conversations with leaders in some of the world’s top emerging e-commerce markets.

South Africa underwent one of the world’s most rigorous lockdowns last year. Essential goods were the only e-commerce items allowed to go on sale, and many companies were put at risk of closure. Some survived, many did not.

As a result of these circumstances, the E-Commerce Forum South Africa (EFSA) worked with the government to effectively and safely reduce the restrictions on e-commerce to help ignite the flailing economy and establish a fresh baseline for growth in a pandemic-affected world.

This saw significant innovation and shifts in approach and perspective, particularly in the e-commerce arena. Retailers adapted quickly, with big names like Checkers Sixty60 and Zulzi changing the way that groceries were bought, while Uber shifted people’s experience of public transport and the delivery of food and other essential products.

Retailers that were unable to keep up with the demand also turned to strategic partnerships. Pick ‘n Pay, for example, partnered with Bottles to introduce a same-day delivery services to its customers – a relationship that was so successful that it saw the retail giant buying the delivery service. OneCart partnered with Exclusive Books and HP to achieve the same levels of delivery efficiency.

Along with the rise of app-based and online shopping experiences, there was significant growth in mobile transactions, with “tap-and go” becoming increasingly relevant as a seamless cashless payment solution.

On our platforms, PayU saw an impressive move to mobile payments during lockdown with up to 85% of transactions completed on a mobile device. This rapid increase in mobile payment usage correlates to the massive increase in smartphone penetration in South Africa. The Independent Communications Authority of South Africa (ICASA) reported in the 2020 State of the ICT Sector report that smartphone penetration has risen by 9.5% over the past year.

In addition to increased usage of mobile devices and payments, there has been a shift in how customers approach mobile payment platforms. They want tools that engender trust, that minimize the risk of fraud and theft, and that allow them to do more than just pay for online shopping.

Changes in consumer attitudes are also changing access to financial services and solutions. From the micro enterprise to the corporate building foundations in a rural community, digital payments offer people access to banking services and cash management tools that previously would have been out of their reach.

The more people gain access to digital financial tools that are secure and affordable, the more they are empowered to grow, reach new markets, and improve their financial acumen. Digital payments are tearing down barriers to financial inclusion and giving SMEs and communities improved opportunities for growth.

Education is a key one, for merchants as well as consumers. For example when it comes to digitizing business models – traditional merchants need to learn how to move business online. Economic growth depends on a flourishing SMB sector and e-commerce can give us that opportunity, but the SMBs need to have the right knowledge. They also need to be able to invest in their digital experience to encourage consumers to shop online.

For consumers, fraud and security remain a high concern and priority. To drive growth in the e-commerce sector, merchants need to invest into payment platforms that showcase their investment into tools such as 3D secure that put security at the forefront of development.

Finally, one of the biggest and most essential changes we need to see in 2021 is further reductions in the cost of data and access to affordable connectivity. Already, significant strides have been made in this arena, but data and internet access costs need to fall even further to reduce the barrier to entry, improve e-commerce growth, boost mobile usage, and increase access to inclusive financial services.

This will drive growth and economic stability while further allowing for the market to cement its digital foundations and translate the complexities of the pandemic into long-term opportunities.

The first opportunity is to find ways of capitalizing on the new African Free Trade Area agreement. The agreement allows for impressive business reach into new markets and, as Africa is a significant market for remittances, this is a chance for merchants to expand their e-commerce footprint into cross-border trade with the right infrastructure, regulations and payments in place.

Another development that has seen growth in 2020 and will continue its trajectory in 2021 is QR payments. These have become far more ubiquitous over the last year with many companies investing into QR-powered mobile solutions that make payments simple, quick and accessible. From Samsung to Apple to Snapscan, the scale and use case for QR codes will continue to evolve. It’s a digitally-driven solution that capitalizes on consumers’ need to shop fast and pay even faster, while presenting new ways of selling goods and services across multiple platforms. QR codes are being used by leading payment platforms to expand South African access to alternative payment solutions that suit their needs, lifestyles and business models.

From digital payment platforms to security innovation to reduced costs and improved payment capabilities, 2021 is the year that will take the card tap to the mobile device and grow the economy in the right direction. 3DS v2 will also become mainstream in 2021 providing a great degree of card safety with an upgraded user experience.

Get further insights on the e-commerce landscape across South Africa and nearly 20 other emerging e-commerce markets where PayU operates around the world.

Combining external sources with local data directly from PayU’s payments platform, our report also provides a window into the payment ecosystem across the countries surveyed, leveraging our experience as a leading payment technology platform offering merchants a single global solution for emerging as well as established markets.

Fill in the form to download our report and learn more about the fast-moving digital landscape in some of the world’s most exciting growth markets for e-commerce.