More e-commerce insights

Stay in the know with the latest e-commerce and fintech trends.

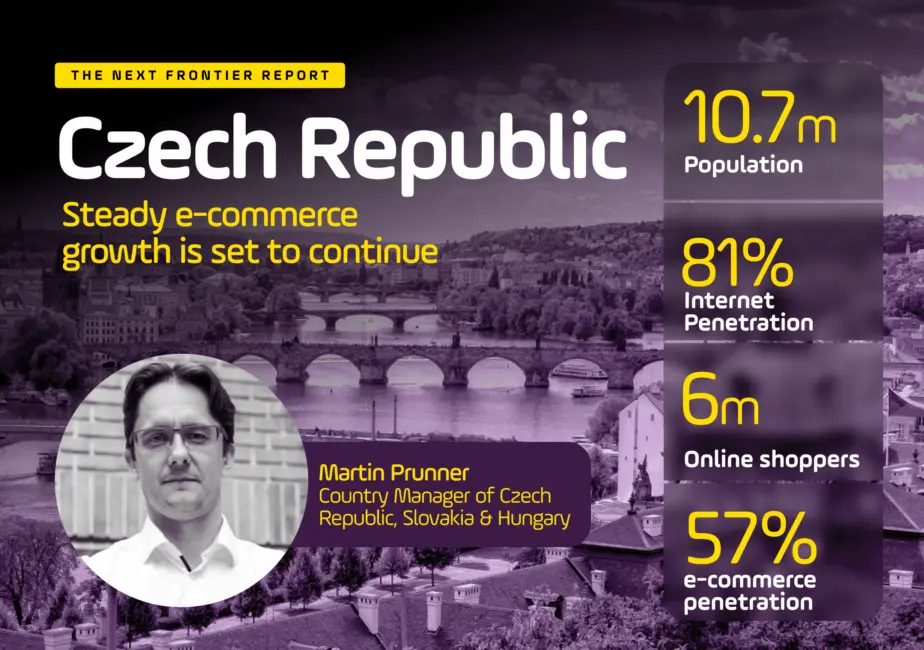

Explore PayU resource hubPayU Country Manager Martin Prunner looks at the landscape for e-commerce in Eastern Europe’s wealthiest consumer market.

According to the comparison shopping website Heureka.cz and the Association for Electronic Commerce in the Czech Republic, Czech e-commerce stores earned a total of CZK 196 billion (about $9 billion USD) in 2020. That represents a 21% increase over 2019 and a more than 30% jump over 2018 levels.

The Czech Republic was already among the fastest growth markets for e-commerce in Eastern Europe even before the pandemic. So how does the landscape for e-commerce and online payments in the Czech Republic look after a wild year? And what are the challenges and opportunities going forward?

As part of The Next Frontier, PayU’s recent report on e-commerce opportunities in emerging markets, we reached out to Martin Prunner, Country Manager for PayU in the Czech Republic, Hungary, and Slovakia, to share his thoughts on the present and future of e-commerce in the region.

Scroll below to read Martin’s responses and be sure to check out our other recent conversations with leaders in some of the world’s top emerging e-commerce markets.

When it comes to the growth trend of e-commerce in 2020, the “elephant in the room” is obviously the influence of COVID-19. This was true all over the world but at PayU we saw a notable amount of first-time e-commerce customers in the Czech Republic and other markets across Eastern Europe.

Due to the closure of stores, many new customers made their first online purchases in the online space, and stayed there. Sales of books, films and games increased the most (by 49%), followed by food (47%), sports equipment (43%), and products for the home and garden, including furniture (38%).

With the growth in e-commerce, we are also seeing a virtuous cycle where modern payment methods are getting more popular and adopted by many people. Buyers are becoming much more accustomed to paying for goods online in advance, which is in turn making them more comfortable with e-commerce as a whole.

The share of cash on delivery, which was a big part of the Czech payment picture previously, has significantly declined. The expansion of Google Pay and Apple Pay is also helping to push the popularity of digital payments.

To facilitate easier delivery of e-commerce goods after purchase, the big Czech e-shops continued to expand their networks of pick-up boxes in 2020. These are becoming increasingly used. The largest e-commerce chain, Alza, already has around 600 of them across the country. Pick-up boxes are also used by some of the other key players, such as Mall (shopping gallery), Rohlík (food delivery), Pilulka (pharmacy) and Zásilkovna (logistics).

All of these pick-up boxes and delivery services are helping to further change online consumers behaviors and increase the level of comfort with safe online payments.

According to current qualified estimates, the Czech Republic has the most e-shops per capita in the whole of Europe. At the end of 2020, there were 45,000 of them in operation and the share of online sales in purchases was 18 percent. And the growth of online sales will of course continue in 2021.

However, with the rapid expansion of payments, it is also necessary to pay attention to thorough security. In 2021, we can expect a higher number of attempts at robbery and fraud. These are also facilitated to some extent by the fact that many new customers have minimal experience, low prudence and they trust in things they should not. Major players in online payments therefore also have the challenge to contribute not only to greater security of transactions, but also to the education of customers, especially those who are less experienced in e-commerce until now.

With the development of online shopping, the emphasis on payment security is fortunately increasing. In December 2020, a new European regulation came into force called Strong Customer Authentication (SCA). This is part of a comprehensive directive known as PSD2 and requires additional steps for banks to ensure that the customer is the actual holder of the card they pay for. The purpose of this regulation is to reduce fraud and properly secure online shops so that customers can feel safe.

From digital payment platforms to security innovation to reduced costs and improved payment capabilities, 2021 is the year that will take the card tap to the mobile device and grow the economy in the right direction. 3DS v2 will become mainstream in 2021 providing a great degree of cards safety with an upgraded user experience.

The whole market is expanding significantly into cross-border payments. This is partly due to the fact that a large percentage of Czech e-commerce customers already buy from abroad. And not only in Europe, but also from North America and China, which offer minimal transport costs despite the distance.

That is why more and more Czechs shop in this way, even those who use the internet relatively little. Due to having a good experience with cross-border e-commerce more and more Czech customers are using online payments more often and without fear, also in domestic transactions. Online shopping is becoming more natural for them and so they do many more domestic payments online as well.

An important factor for the expansion of online transactions is the fact that a number of successful Czech e-commerce players have been establishing and developing their branches in other countries in recent years, mainly in Europe. The PayU payment orchestration platform is a very useful tool in this regard. Thanks to having a single platform for accepting payments from almost any market around the world, merchants can start selling in other countries quickly via one payment processor.

Finally, as in so many other places, the share of business transactions and payments from mobile devices has also been increasing in the Czech Republic. E-commerce and payment solutions for mobile devices are emerging and improving, for example VISA’s click-to-pay option. Merchants operating in the Czech Republic appreciate great solutions like PayU Mobile that provide a better user experience during payments on mobile devices.

Get further insights on the e-commerce landscape in the Czech Republic and nearly 20 other emerging e-commerce markets where PayU operates around the world.

Combining external sources with local data directly from PayU’s payments platform, our report also provides a window into the payment ecosystem across the countries surveyed, leveraging our experience as a leading payment technology platform offering merchants a single global solution for emerging as well as established markets.

Fill in the form to download our report and learn more about the fast-moving digital landscape in some of the world’s most exciting growth markets for e-commerce.