Emerging e-commerce leaders

Visit PayU’s resource hub for more information on e-commerce in the developing world.

Learn moreExpanded internet access and the rise of mobile commerce have been the main drivers for e-commerce growth in emerging markets.

E-commerce continues to soar in emerging markets, driven by growing middle classes, increased internet penetration, and the expansion of mobile commerce.

The e-commerce potential of developing countries has long been clear. A 2015 survey conducted by Credit Suisse Research Institute on the latest emerging consumer showed that the overall annual online retail sales across surveyed markets – which included China, Brazil, India, Mexico, South Africa, Russia, Saudi Arabia and Turkey – could reach $3.5 trillion USD as e-commerce spending converges with existing levels in developed countries. In addition to the rapid rise in internet access, other factors propelling online retail are expanding incomes, which are resulting in a larger emerging middle class shopping online for products and services.

The majority of consumers from emerging markets are predominantly making online purchases through smartphones rather than by means of the fixed-line-based internet, due to the fact that in regions which include Asia Pacific, Latin America and Africa, mobile handsets are the first web-enabled device the majority of the populations have access to. Already fully established e-commerce markets may have much higher mobile device counts and internet access, however, consumers in developing countries make greater use of smartphones to shop compared to their wealthier counterparts.

According to the survey conducted by Credit Suisse, if internet usage across the developing countries reaches the levels found in developed countries, this would result in an additional one billion internet users in the nine countries surveyed, with India and China likely to have the largest number of prospective consumers to this projection. At the time the survey was conducted, two-thirds of the internet access was through smartphones in India, and close to three-fifths in China. This indicates the importance of having a well-thought-out mobile commerce strategy for companies planning to benefit from the ongoing e-commerce boom in emerging markets.

Although developing countries still need to catch up with developed countries in terms of e-commerce infrastructure, they are likely to see stronger sales growth in the future. Because of this, the global e-commerce landscape may change rapidly over the course of the coming years.

According to LSE’s Emerging Markets Forum:

“While China and India continue to dominate the e-commerce market outside of the US, companies in Africa, Southeast Asia, and Latin America have helped spur growth in their respective regions and should be watched as potential global competitors in this space.”

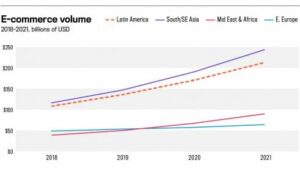

A good example is Indonesia, which has set itself apart as a mobile-first country. It was recorded that in 2015 more than 70% of Indonesia’s online sales were made through mobile devices. Latin America’s e-commerce market, meanwhile, reached $100 billion in 2018 and is expected to grow by 25% to the end of 2021. With three Latin American nations (Brazil #2, Mexico #6, and Argentina #8) in the top 10 countries overall for total internet usage, yet with rates of online shopping that lag behind those seen in the United States and Canada, the fundamentals are in place for further growth.

Source: Latin American Business Stories/Americas Market Intelligence

Developing countries currently present a variety of unique opportunities in maturing to some of the biggest e-commerce segments. Their shortcomings, such as payment challenges and poor logistics infrastructure mean there is also significant untapped potential, which if tapped into could lead to continuous progress. An expanding middle class, with more spending power, will also continue to boost e-commerce markets in emerging regions.

Further reading: