15/11/2022

Opening up new territories in Africa

Tapping into African markets was a key objective on Oriflame’s roadmap for global expansion. PayU was ready to take up this challenge, helping the merchant to expanding its footprint in the region, while at the same time providing online payment processing for Oriflame’s biggest markets in Europe.

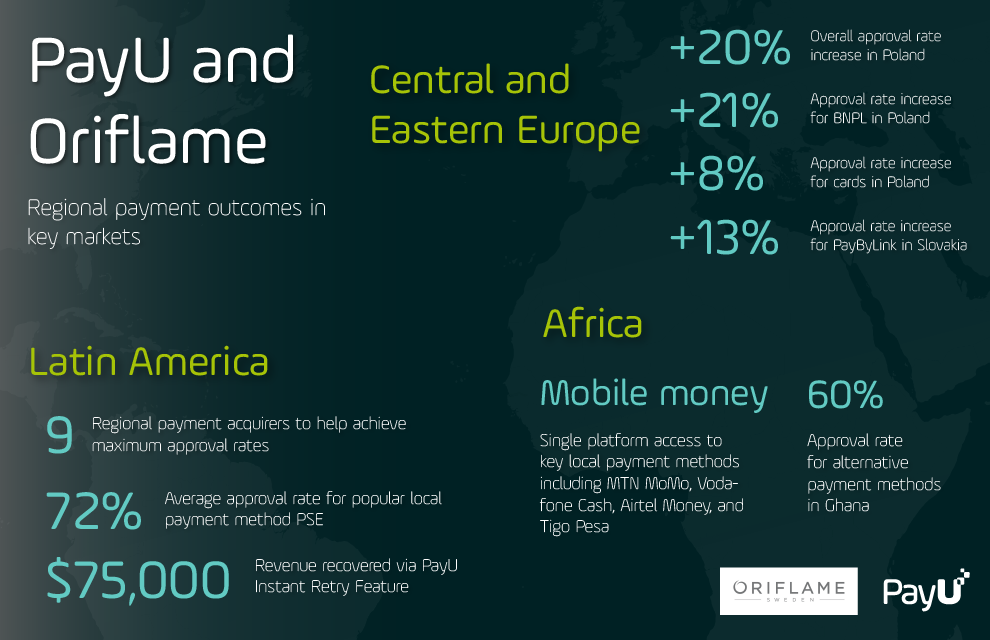

With popular local and alternative payment methods driving e-commerce growth in the region by providing more options in terms of how consumers pay for goods, accommodating local payment preferences was a key strategic factor for Oriflame. This included providing Ghanaian shoppers with the ability to pay by card, along with offering popular mobile money payment methods such as MTN MoMo, Vodafone Cash, Airtel Money, and Tigo Pesa.

By gaining access to the Ghanaian market via a single integration through the PayU payments platform, Oriflame achieved approval rates for alternative payment methods-driven transactions of 60% in this particular market.

And in Nigeria, a key market for Oriflame, online shoppers can now buy Oriflame products and pay via card and bank transfers.

Overall, PayU improved approval rates for Oriflame across the region, while reducing operational costs, centralizing existing countries under one single payment integration, and helping the merchant to enable locally relevant payment methods and open up new markets.

Catering to consumer payment preferences in LatAm

Just like customers in other regions, consumers in Latin America have unique shopping attitudes and preferences. By offering a wide mix of locally popular alternative payment method options at checkout like Webpay Plus and PSE, Oriflame became better placed to make the most of the e-commerce opportunity in Colombia, Chile and Peru.

In Colombia, PSE – the most popular local payment method that allows users to pay directly from their bank account – reached a performance of 72% on average in the last 12 months. In Chile, another local payment method preferred by consumers – Webpay Plus, witnessed a 3% growth in approval rates over the last 6 months of 2021.

PayU’s multi-acquirer relationships with 9 acquirers across the region helped Oriflame to keep payment processing costs down while also increasing the chances of payments being approved. As recent research indicates, a multi-acquiring strategy drives acceptance rates up to 16% higher, as compared to a single acquirer setup.

The PayU platform also help to accelerate Oriflame’s business across Latin America through the Instant Retry Feature – our unique capability which saves failed transactions by re-routing them through a set of pre-configured rules. By enabling this feature, Oriflame saved over $75,000 in the past months in key LatAm markets.