Explore more

Our Insights hub is full of resources on e-commerce, fintech, and financial inclusion in emerging markets.

Go to Insights overviewEastern Europe and Latin America are among the top emerging markets for fashion e-commerce, while South Africa is also growing fast. Part 2 in our emerging e-commerce market vertical series.

Many consumer verticals have benefited from the e-commerce boom of the past year, but across multiple markets and geographies, the fashion sector has been one of the true winners. Consisting of apparel, footwear, and bags & accessories, fashion was already a well-established e-commerce sector before the COVID-19 pandemic. As more and more retail moves online, e-commerce in fashion shows no signs of slowing down anytime soon, with both the number of online transactions and overall spending levels continuing to jump almost everywhere you look.

Fashion and Gallantry was one of four market verticals examined in The Next Frontier, PayU’s recent report looking at e-commerce growth across 19 emerging markets in Europe, Africa, Latin America, India, and Southeast Asia. Across every market in our report, fashion emerged as the market segment with the highest consumer spend.

In Part 2 of our E-Commerce Sector Series, we take a look at the key regions where e-commerce spending on fashion is growing the fastest – according to external information as well as our own data from PayU’s payment platform in key emerging markets.

Scroll below the image to keep reading or click to read the first post in our series looking at global e-commerce developments in Beauty and Cosmetics.

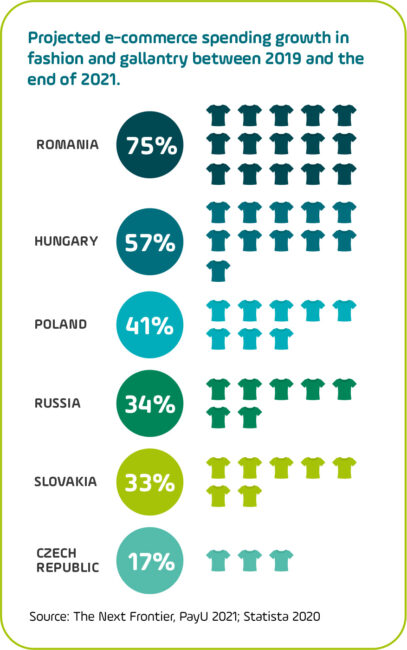

Eastern Europe offers a wide range of possibilities for merchants in the fashion vertical, from comparatively more established e-commerce markets like Poland (which still have a long runway ahead of them), to Romania, where e-commerce was already growing at 30% per year even before the pandemic.

Fashion and Gallantry is the most established e-commerce sector in Poland, with consumer spend exceeding USD $5.7bn in 2020. According to external data, e-commerce spending on fashion is expected to have grown by 41% from 2019 levels and reach USD $6.49bn by the end of 2021.

Data from PayU’s platform paints an even stronger e-commerce picture for Polish fashion. Between 2019 and 2020, fashion spending in Poland on this category through our platform grew by 83%.

Of the five European countries we investigated, meanwhile, external data suggests that Romania is where e-commerce spending on fashion is growing the fastest. Before the end of 2021, e-commerce is expected to have jumped 75% compared with 2019 levels, passing USD $1bn for the first time. Revenues are expected to show an annual growth rate of 10% between 2021 and 2025, resulting in a projected market of USD $1.6bn by the middle of the decade.

As was the case in Poland, we saw massive percentage increases in year-on-year fashion spending on the PayU platform in Romania during 2020. The lion’s share of this growth was seen in Q2, when e-commerce spending on clothing and accessories was up 1715% versus our 2019 platform levels in Romania. For 2020 as a whole, fashion merchants on our Romanian platform took in 1192% more sales than in 2019.

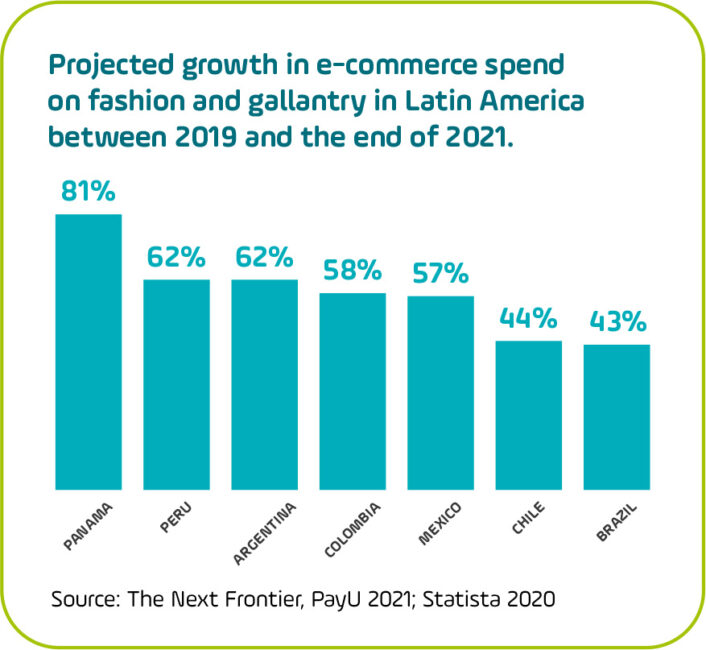

Over USD $14bn was spent online on Fashion and Gallantry in Latin America in 2020, according to external data. On PayU’s platforms, we saw triple digit (191%) growth in year-on-year consumer online spend in this sector – led by Colombia, Mexico, and Brazil.

Fashion spending on our platform in Colombia grew by 124% in 2020 – which is all the more impressive considering that Colombia was already one of PayU’s leading markets before the pandemic. Argentina, meanwhile, saw 447% growth in total spend and also had the highest average transaction value ($108) of any of our Latin American markets.

Latin America is synonymous with flair and style, and despite the pandemic putting a pause on weddings, parties and gatherings, it has clearly not been enough to put a damper on online spending when it comes to fashion items and accessories. In Brazil alone, fashion transactions on our platform grew by more than 500% last year. The external data below shows the projected growth of the fashion segment from 2019 until the end of 2021, further demonstrating the potential for merchants targeting this market vertical in LatAm.

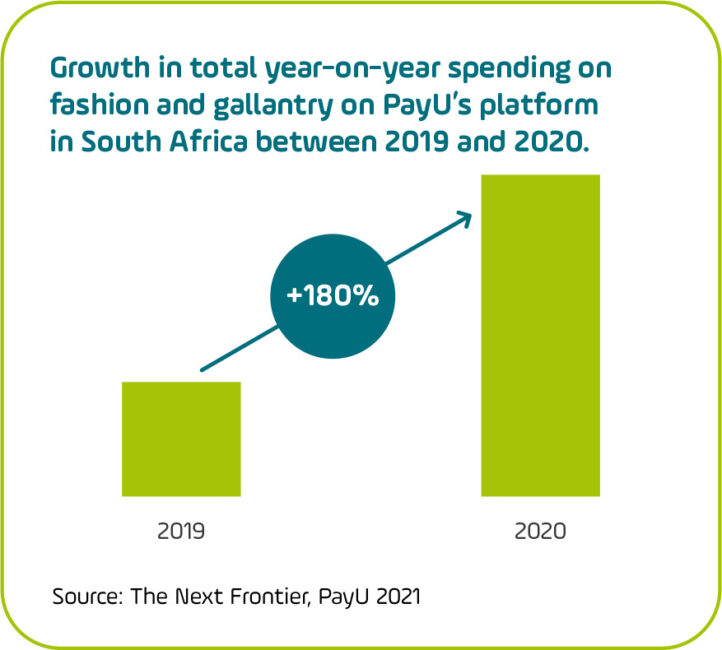

A key under-the-radar market worth watching for online fashion merchants is South Africa, where according to external data, e-commerce spend on clothing and accessories is projected to grow by 54% between 2019 and 2021, falling just short of USD $1.5bn (slightly outpacing Romania).

On PayU’s platform, consumer spend on Fashion and Gallantry rose by 180% between 2019 and 2020, with the average transaction value also increasing by $11.

For merchants interested in other key rising e-commerce markets in Africa, both Kenya and Nigeria are also seeing significant growth, particularly in fashion. Online fashion spend in Nigeria reached $1.8bn USD in 2020, while in Kenya, external data projects that e-commerce in clothing and accessories will reach $500m USD by the end of 2021. While still modest in terms of total volume, this would represent a jump of 160% compared with 2019 levels.

Throughout the countries examined in our report, overall predicted sales volumes in the fashion segment tend to correlate with the largest population centers. By the end of 2021, annual consumer e-commerce spend in the fashion segment is projected to be particularly high in India ($16bn) and Indonesia (>$9bn), followed by Russia, Poland, and Turkey (>$6bn), and then Brazil and Mexico (>$5bn).

It’s worth noting the markets where spending levels are notably high relative to the size of the country’s population. Poland for example, with a population of 38 million, saw levels of online fashion spending on par with Russia (146 million), and well ahead of Brazil (213 million). Colombia meanwhile has less than a quarter of Brazil’s population but Colombian e-commerce shoppers will have spent nearly half as much as Brazilians on fashion purchases by the end of 2021.

This data further reinforces what we have long known at PayU: that many of the most promising emerging markets for e-commerce are not always the typical large consumer markets, but also mid-sized countries like Colombia, Poland, and Romania where e-commerce fundamentals are strong and the market is growing quickly.

Turkey, with a population of 83 million (roughly the same size as Germany) will be another interesting market to watch in the years to come. Though not as high a percentage increase as in some of PayU’s other markets, our platform saw significant growth in Turkey during 2020, with fashion sales up 65%.

Get further insights on the e-commerce landscape in Fashion and other key market verticals such as Education, Beauty and Cosmetics, and Digital Goods across the world’s fastest-growing online consumer markets.

We also provide insights on the local payment ecosystem, leveraging our experience as a trusted provider of payment technology and features offering merchants the best conversion rates in emerging markets.

Fill in the form to download our report and learn more about the fast-moving world of e-commerce in some of the most dynamic regions around the globe.