Further insights

Watch our webinar about offering local payments in Latin America – and why it’s essential for e-commerce success.

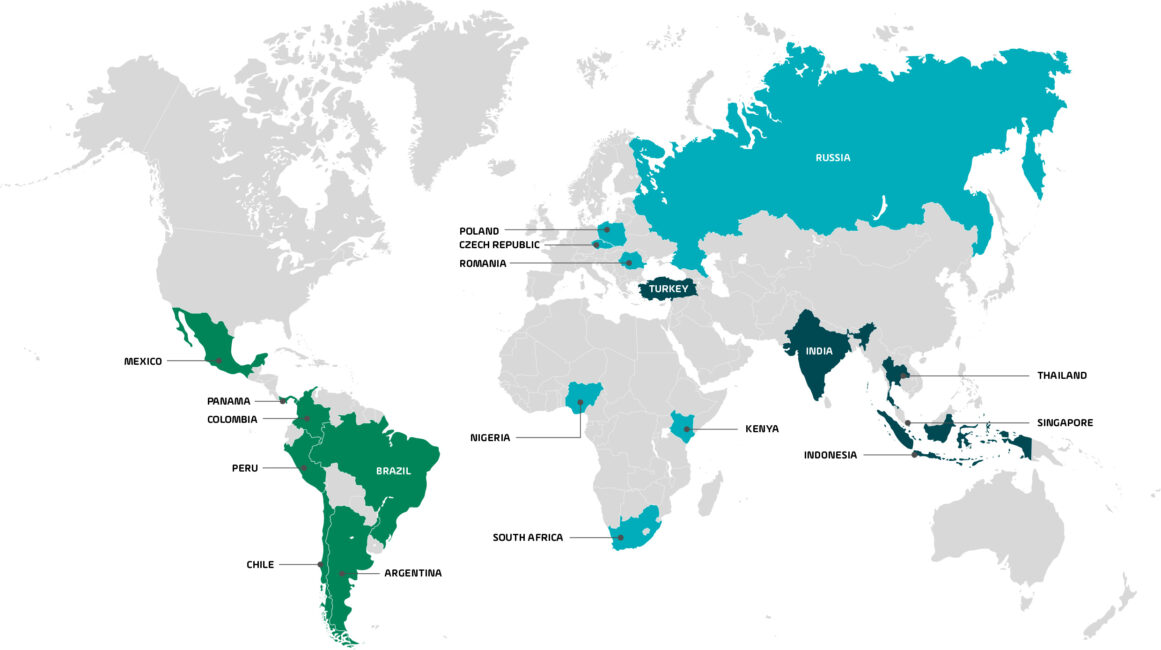

View webinarThe Next Frontier is PayU’s global e-commerce report covering online consumer spend across 19 emerging markets.

COVID-19 has resulted in a surge in e-commerce spending worldwide. But the effects of the pandemic are just a small part of a much bigger picture. Although e-commerce use has expanded substantially in the last year, across many global markets the pandemic has only accelerated fundamental changes that were already gaining traction even before a record number of new businesses began selling online.

PayU provides global payment solutions tailored toward the world’s most dynamic emerging markets – where growing levels of internet and mobile penetration, efforts to broaden financial inclusion, and improvements in consumer trust and security when it comes to online payments have all contributed to the creation of a vibrant e-commerce ecosystem which has been a bright spot amidst the economic uncertainty of the past year. Even before the pandemic, governments in a number of countries were making significant attempts to foster increased digitalization of the economy and society, with e-commerce as a fundamental pillar. Amidst the ongoing uncertainty of COVID-19, these efforts are continuing to pay off.

Never has the global e-commerce landscape been more exciting. Multiple factors are bringing more global businesses and consumers to the table, creating a “tipping point” for e-commerce adoption in many new markets – and exciting opportunities for online and multi-channel retailers.

As these global trends accelerate, PayU has released a new analysis showcasing online consumer spending growth across 19 emerging economies that have traditionally been eclipsed by more mature e-commerce markets – but should no longer be ignored.

Combining external sources with primary data directly from PayU’s online payments platform, our report is targeted toward fast-growing online and omni-channel merchants interested in realizing the considerable potential of the e-commerce landscape in emerging markets.

Here is a teaser of some of the key insights from our report:

In order to grow sales and expand their customer base, emerging e-commerce leaders must continue to conquer new global markets. Yet even with the comparative ease and accessibility of selling online, emerging markets can be a challenge for newcomers. To succeed businesses must have a thorough understanding of each market, as well as the local payment environment and local customer preferences.

PayU’s Next Frontier report examines trends in four industry sectors where we believe emergent e-commerce leaders will have the most growth potential in the coming years: Beauty & Cosmetics, Fashion & Gallantry, Digital Goods, and Education.

We also provide information and insights on the local payment ecosystem in each market, based on our expertise as a recognized provider of cutting-edge payment technology and services that help merchants achieve the highest conversion rates with the lowest possible transaction costs.

Fill in the form below to download your copy of The Next Frontier report and learn more about the e-commerce picture across some of the world’s most dynamic global markets.