Discover more

Visit our Insights page for more on the state of e-commerce, fintech, and financial inclusion in emerging markets.

Go to Insights overviewAs more business moves online, spending on digital goods is high and growing fast across all of PayU’s key markets. Part 4 of our emerging e-commerce market vertical series.

It’s no secret that demand for just about every digital product and service has increased during the past year. And while the initial digital surge during the first wave of the COVID-19 emergency may have felt like a singular event at the time, the aftermath of last year’s rapid uptake is beginning to give way to more sustained changes in the digital realm that look to be here to stay.

For much of the past 12 months, the focus of the conversation has been on developments in the richest global markets, where the shift to digital has also been transformative. But what about the markets around the world that don’t get all the attention? As has become all too painfully clear, the coronavirus has no awareness of borders or national identity. Just as the pandemic has affected everyone around the world, the social, economic, and societal changes of the last year have also affected every country uniquely.

With this global impact in mind, The Next Frontier is PayU’s report looking at growth in digitization and e-commerce across 19 emerging markets in Europe, Africa, Latin America, India, and Southeast Asia. Digital Goods was one of four key market verticals surveyed in our report, combining digital music, video-on-demand (VOD) platforms, streaming platforms, video and audio-conferencing platforms, and online publishing.

Part 4 of our E-Commerce Sector Series looks at the landscape for digital goods across a handful of the key emerging markets in our report. Looking at external sources as well as primary data from PayU’s global payments platform, we take a deep dive into the numbers to see which countries show the most potential for online merchants in the wake of the current digital upheaval.

Scroll below the image to keep reading, and be sure to check out the earlier posts in our series looking at global e-commerce developments in Education, Fashion, and Beauty and Cosmetics.

The digital landscape in Eastern Europe has long been a focus for PayU. The explosive growth of e-commerce across the region over the past year is thus hardly a surprise. With growing internet penetration and rising levels of consumer wealth, e-commerce was already on fast growth trajectory even before the pandemic in markets like Poland, Romania, and the Czech Republic, which together represent a population of nearly 70 million. In this way, the pandemic has only supercharged developments which were already brewing under the surface.

Across the European markets we analyzed, e-commerce spend in the digital goods segment is growing the fastest in Romania, according to external data. Between 2019 and the end of 2021, spending on digital goods in Romania is expected to have increased by 54% – a testament to how quickly Romanian consumers are adopting digital products and services. Government-led efforts to encourage digitization across the Romanian economy have been complemented by private sector investment to improve digital consumer interfaces, making the online experience better for customers and helping to unleash pent-up digital demand.

The Czech Republic also remains a significant contributor to e-commerce growth in Eastern Europe, despite its relatively small market size. External data predicts huge growth in e-commerce spending on digital goods in the Czech Republic, with market values reaching nearly $200m USD by the end of 2021, up 33% on 2019 levels.

According to external data, Poland’s projected growth in e-commerce spend on digital goods between 2019 and 2021 is second only to Romania’s, growing at 39%. By the end of 2021, spend in the sector is expected to reach $615m USD. Data from PayU’s payments platform in Europe showed 36% growth in year-on-year spend on digital goods in Poland between 2019 and 2020.

Despite a lower rate of growth, the market for digital goods in Russia also remains vibrant. By the end of 2021, spend in the sector is expected to reach $1.41bn USD, with data from PayU’s Russian platform showing a 28% increase in Russia between 2019 and 2020.

In Turkey, total e-commerce spending on digital goods is expected to have jumped 52% over 2019 levels by the end of 2021, reaching $879m USD.

South Africa was one of PayU’s standout markets within the education sector in 2020, with average transaction values on our platform nearly quadrupling.

Across the digital goods vertical, e-commerce spending is projected to grow by 46% between 2019 and the end of 2021, reaching $336m in total spend. South Africa still trails Nigeria as Africa’s largest market for digital goods, but the levels of growth indicate a bright future for this sector.

According to external data, average year-on-year growth in the digital goods segment in Colombia stands at 14%, which was lower than many of PayU’s other Latin American markets.

However, this is one instance where the PayU platform provides an important counterweight to external projections. Across the digital goods segment, our platform in Colombia saw significantly higher growth in 2020 (62%) both from existing as well as new merchants, as more consumers flocked to digital offerings.

Brazil and Mexico remain the largest Latin American markets in terms of absolute value, at $3.16bn USD and $2.1bn USD, respectively.

In addition to Colombia, Mexico, and Brazil, we saw significant growth in the digital goods segment across multiple other Latin American markets in 2020. Digital goods spending increased in Chile by 211% in Argentina by 131%, according to our platform data. In Argentina, total spend on digital goods is expected to reach $615m by the end of 2021.

Peru is another interesting market to watch for emerging e-commerce leaders in the coming years. Although still a relatively small market for e-commerce, it has still grown quickly over the past decade. According to the US Department of Trade, e-commerce in Peru could be worth $14 billion a year by 2022, up from just $4bn in 2019.

Historically, e-commerce in Peru has been held back by a lack of consumer trust in online payments. But as in so many other markets, the pandemic has accelerated the growth of online shopping, and with it, the level of comfort in shopping online. The volume of online transactions soared by 120% in just one month between February and March 2020. At the same time, where e-commerce accounted for just 12.5% of Peruvian credit card transactions between January and March of 2020, by June this had grown to nearly half (45%) of all transactions.

According to external data, total e-commerce spend on digital goods in Peru is projected to surpass $300m USD by the end of 2021.

South Africa is a promising market for any digital merchant, particularly in higher-value sectors such as education and digital goods. With that said, merchants should also look further north for opportunities in the digital goods vertical, specifically at Kenya and Nigeria, which continue to be two of Africa’s leading e-commerce growth markets.

With a project market value of nearly $1bn USD by the end of 2021, the digital goods segment in Nigeria is the most valuable in Africa, according to external data, with a large, young, urban, and digitally savvy population set to drive further growth in online products and services in the years to come.

The market in Kenya remains significantly smaller but it is also growing rapidly. Kenya’s digital goods vertical is expected to grow by 94% from 2019 levels by the end of 2021, reaching $70m in total consumer spend after digital platforms proved to be a significant lifeline for the country’s artist and musician community during the early months of last year’s crisis.

Digital goods, which includes streaming services, was one of the fastest growing Russian e-commerce sectors in 2020, with total online spend growing by 23% to a projected $1.02bn by the end of 2021.

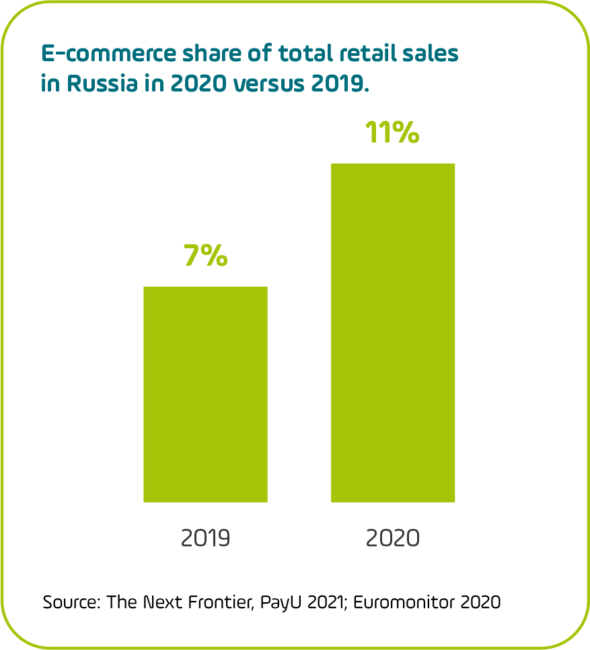

The core e-commerce challenge in Russia has long been the logistical challenges associated with the country’s remote geography and sparsely populated outlying regions. With such challenges presenting less of a burden when it comes to services such as streaming, online publishing, and video and music platforms which are largely consumed online, the digital goods sector has helped to significantly increase the share of e-commerce as a percentage of total retail sales in Russia over the past year.

Get further insights on the e-commerce landscape in Digital Goods and other key market verticals such as Education, Fashion, and Beauty and Cosmetics across some of the world’s fastest-growing online consumer markets.

We also provide insights on the local payment ecosystem, leveraging our experience as a trusted provider of payment technology and features offering merchants the best conversion rates in emerging markets.

Fill in the form to download our report and learn more about the fast-moving digital and e-commerce landscape in emerging markets around the world.