Leadership through knowledge

Take a deep dive into the rapidly changing world of e-commerce and fintech.

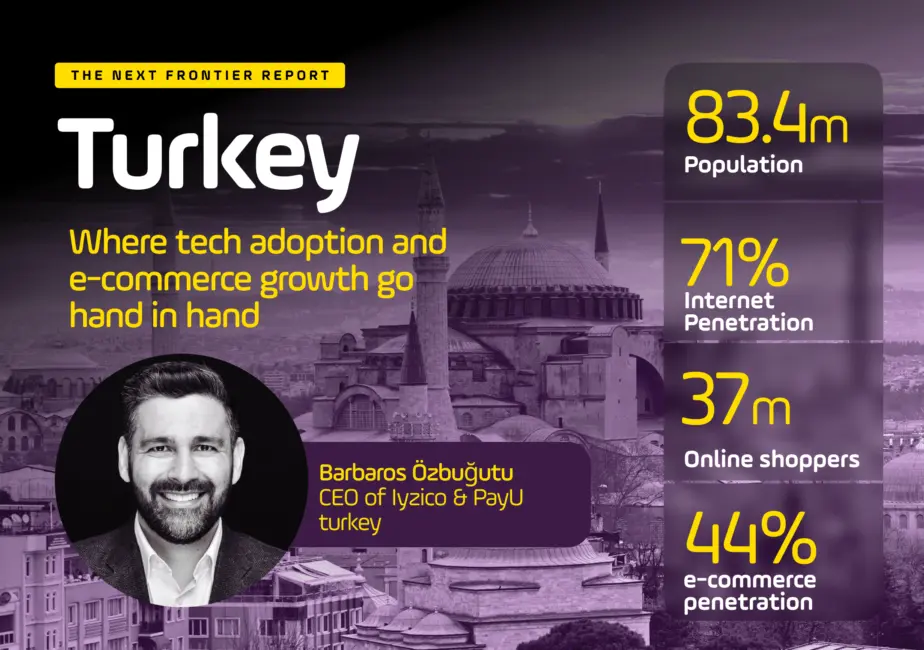

Visit resource hubBarbaros Özbugutu, CEO of iyzico and PayU Turkey, looks at how the adoption of new technology is transforming Turkish retail.

It’s almost impossible to comprehend the impact that the technology sector has had in Turkey in a little over 10 years. New technology now comes to the fore in almost all aspects of Turkish business and society.

Turks are among the world’s most active users of tech: according to the Digital 2020: Turkey report from Data Reportal, the average person in Turkey is online for 7.5 hours per day. More than 92% of the population, meanwhile, use a mobile device.

With a strong digital sector that was already on the rise even before COVID-19, what is the outlook for e-commerce and online payments in Turkey as we look ahead to the future? And what are the challenges and opportunities going forward? As part of The Next Frontier, PayU’s recent report on e-commerce opportunities in emerging markets, we reached out to Barbaros Özbugutu, CEO of iyzico, a PayU company and one of the leading providers of payment technology on the Turkish market.

Scroll below to read the responses from Barbaros on the present and future of Turkish e-commerce –and be sure to check out our other recent conversations with leaders in some of the world’s top emerging e-commerce markets.

Turkey is a dynamic country with strong entrepreneur resources. The change in shopping behavior of consumers over the past year, combined with the rapid growth of technology has led to a massive proliferation of digital payment methods and digital wallets in Turkey.

In March of 2020, everything from standards of judgement to business conduct, education methods and manner of receiving healthcare changed suddenly. Upon WHO’s declaration about the danger of banknotes, zero contact became the new normal, and this, in turn, made digital wallets and contactless payments increasingly essential.

Both for online as well as offline commerce, these developments are leading Turkey in the direction of a cashless society. We can give a 14 percent decrease in the cash withdrawal rate from ATMs and three-fold increase in contactless payments as examples of these developments. With all of this in mind, fintech is an increasingly basic ingredient of doing business in almost every sector.

The fact that more than 68,000 businesses are active in the Turkish e-commerce sector indicates the importance already attached to e-commerce in Turkey. At the same time, the pandemic also gave way to new developments for the e-commerce world. Sectors that came to a halt realized that e-commerce was the way to survive and shifted their investments accordingly.

With lockdowns and quarantine practices, individuals benefitted from the practicality, speed and variety of online shopping. During the first half of last year, e-commerce volumes in Turkey grew by 64% compared to the first six months of 2019 and some sectors saw an increase of up to 3 times in the pre-pandemic period. Nearly a third of artisans in Turkey even started using e-commerce.

International competition in the e-commerce sector in Turkey has helped to grow the market as a whole. Amazon’s entry into the market has had a big impact. Alibaba has also made significant investments into the market after acquiring Trendyol, one of the most important e-commerce companies of Turkey, in the last year. One main impact is that they have started to offer more attractive payment and delivery options to the consumer, which has led to increases both in competition as well as market adoption within the e-commerce sector.

The fact that the buyer and the seller do not see one another in e-commerce can constitute a big obstacle, particularly for new brands. Cybersecurity is another big concern.

With that said, a few important steps have been taken in terms of security in the e-commerce world in Turkey. Digital signature and digital certificate concepts have been developed so that the two parties can be sure of each other’s identity. Security standards like SSL and SET are quite critical in terms of information security. E-commerce sites meeting these criteria can prove their reliability by receiving a trust seal.

At the end of the day, it all comes down to the trust of the consumer, especially in the payment experience. For this reason, it is quite critical that e-commerce sites offer services with an infrastructure with BDDK license and PCI-DSS approval.

The Turkish tax system is based on physical assets. Therefore, qualities inherent in e-commerce, namely the difficulty of determining the actual location of the buyer and seller, can cause some problems.

E-commerce can also pose a problem in terms of Banking and Insurance Transaction Tax (BITT). As internet banking transactions are free of charge, these transactions are out of the scope of BITT. The fact that persons earning income through e-commerce prefer banks dealing in offshore banking can cause new problems in terms of BITT.

One of the problems encountered most frequently by e-commerce sites in Turkey are poorly managed shipping processes. As long delivery processes harm the brand loyalty of customers, delivery processes should be managed in coordination with reputable cargo and logistics providers. Informing customers on delayed deliveries and making up for mistakes with gifts or discount codes will always have a positive impact on customer loyalty.

COVID-19 has had a devastating impact on some sectors. However, it also created many opportunities. All procedures, protocols, relations needed to be re-evaluated, which revealed underlying weaknesses and has the stage for necessary improvements. The most concrete indication that the pandemic is an opportunity for the e-commerce world is the number of Turkish artisans who have started using e-commerce. The necessity of zero contact caused by the pandemic showed how we can focus more on next generation payment systems and ways of doing business, as a means of increasing financial inclusion.

Even though there is still significant progress to be made, the digital transformation of Turkish businesses and the public sector becomes more common with every passing day. Digitization of businesses acting as sellers has certainly had a positive impact on their status in e-commerce, and has led to more companies moving all of their processes to digital. Studies conducted by universities and research companies in Turkey have shown that retail is one of the sectors in the Turkish economy that is digitizing most rapidly.

In normal commercial relations, many factors help to establish the feeling of trust between buyer and seller in our subconscious – often before we even realize it. During the pandemic, when millions of new users have shopped online in Turkey for the first time, the experience of being able to do so in a safe and secure way has helped internet users in Turkey to establish a similar level of trust when it comes to e-commerce.

Over the last year, we can see that the Turkish population, who have a societal personality open to innovation, have adapted rapidly to online shopping and new payment methods.

Not leaving consumer security to the mercy of sellers, and securing the consumer by protecting them with important steps like secure data storage and payment, is a mission that helps to distinguish our approach here in Turkey as a provider of e-commerce payment technology.

Get further insights on the e-commerce landscape across Romania and nearly 20 other emerging e-commerce markets where PayU operates around the world.

Combining external sources with local data directly from PayU’s payments platform, our report also provides a window into the payment ecosystem across the countries surveyed, leveraging our experience as a leading payment technology platform offering merchants a single global solution for emerging as well as established markets.

Fill in the form to download our report and learn more about the fast-moving digital landscape in some of the world’s most exciting growth markets for e-commerce.