-

Payment Solutions

Payment Solutions

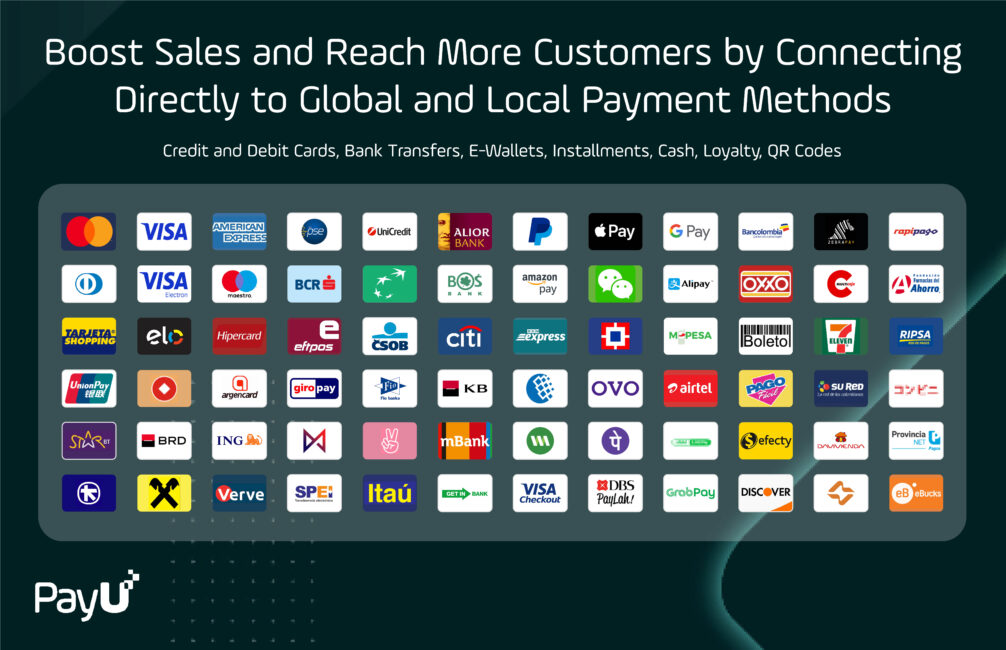

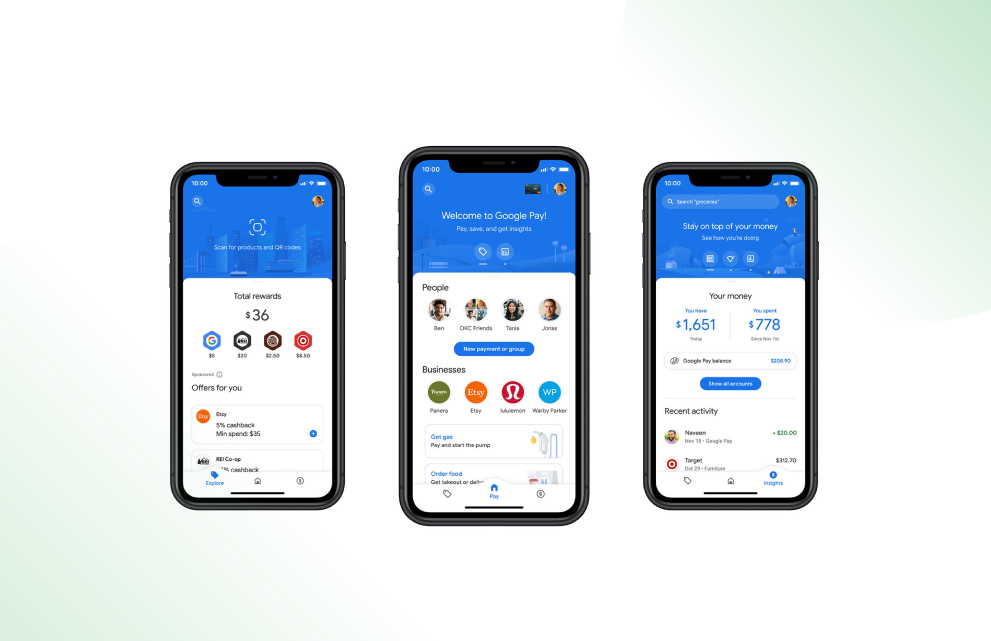

Payment SolutionsPayU’s global payment platform allows merchants to accept payments in CEE, LatAm and Africa, while enabling a wide range of payment optimization and security features via a single API.

- Learn more

- Payment Solutions

PayU’s global payment platform allows merchants to accept payments in CEE, LatAm and Africa, while enabling a wide range of payment optimization and security features via a single API.

- Learn more

-

Services

Services

ServicesDiscover value-added payment services available via PayU, from industry-leading payment security and fraud protection to optimization features for getting the most out of your online payments.

- Learn more

- Services

Discover value-added payment services available via PayU, from industry-leading payment security and fraud protection to optimization features for getting the most out of your online payments.

- Learn more

-

Credit

Credit

CreditPayU has a dedicated credit division with multiple products for BNPL and installment payments available around the world.

- Learn more

- Credit

PayU has a dedicated credit division with multiple products for BNPL and installment payments available around the world.

- Learn more

-

Resources

Resources

ResourcesBrowse our blog and knowledge hub to learn more about key topics related to payments, fintech, and financial inclusion in emerging markets.

- Learn more

- Resources

Browse our blog and knowledge hub to learn more about key topics related to payments, fintech, and financial inclusion in emerging markets.

- Learn more

-

About PayU GPO

About PayU GPO

About PayU GPOOperating in over 50 countries and home to more than 43 nationalities, PayU is one of the world’s leaders in global payments and innovative fintech.

- Learn more

- About PayU GPO

Operating in over 50 countries and home to more than 43 nationalities, PayU is one of the world’s leaders in global payments and innovative fintech.

- Learn more