24/02/2022

BNPL solutions in the Middle East and Africa

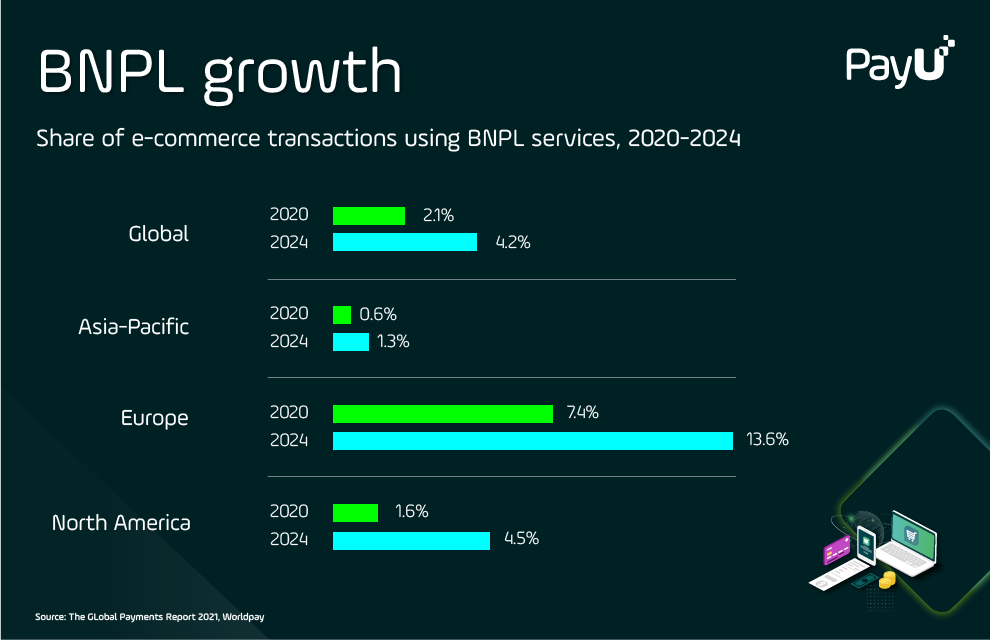

With EMEA as a whole accounting for the world’s largest share of BNPL transactions via e-commerce, the Middle East and Africa will be key BNPL markets to watch over the coming years.

Here are some of the key solutions which are increasing the share of digital BNPL transactions across these two dynamic regions:

- Payflex. Payflex is a homegrown South African BNPL market leader founded in 2017. At checkout, users can select Payflex as a payment method and receive a credit decision in under a minute. Users can then split their payment into 4 installments over a total of 6 weeks, with the first installment due at checkout.

- RCS. This accredited consumer finance company offers users access to a shopping network where they can purchase products via installment payments. RCS also provides its customers with a card they can use to shop at over 26,000 stores across South Africa.

- Tabby. Using Tabby, retailers can offer their customers two comfortable ways of paying for purchases. Consumers have the option to split purchases into 4 equal payments and pay one bill per month without any interest. Alternatively, they can pay within 14 days.

- Tamara. Another popular BNPL solution, Tamara allows consumers to split payments into three. One-third of the amount is paid upfront and the rest settled over 60 days. The services don’t incur any fees or interest.

BNPL solutions in North America

While Europe may have established itself first as the leading BNPL stronghold, the United States, Canada and Mexico aren’t far behind. In 2021, the number of BNPL users in the US had increased by 81% year over year. In addition to homegrown giants like PayPal and new BNPL entrants like Affirm, the US is also a top growth market for international names like Klarna (Sweden) and AfterPay (Australia).

In addition to Klarna, which has established a foothold in the US, here are a few of the top BNPL players in North America:

- Affirm. With 12,000 merchants under its belt (including Amazon, Peloton, and Target), San Francisco-based Affirm is a top choice for US consumers looking for installment payments. Online buyers can use the web or a mobile app to use Affirm’s single-use virtual card across any retailer (both online and in-store).

- Afterpay. Used by some 100,000 merchants around the world, Afterpay offers one loan option: customers can pay for their purchases via 4 installments made over the period of 6 weeks. They can also take advantage of the Afterpay Card for in-store payments at select retailers such as CVS, Target, Nordstrom, and Macy’s.

- PayPal’s ‘Pay in 4’. With PayPal’s Pay in 4 service, customers can spread their payments into 4 installments that are due every two weeks. In total, the entire amount is paid off within 6 weeks, with the first payment due at the time of purchase.

- Sezzle. Founded in 2016, Sezzle is another popular BNPL product in North America. In addition to its partnership with US mega-retailer Target, Sezzle is among multiple American providers bringing BNPL into healthcare, working with a leading American urgent care provider to give patients the opportunity to pay off medical expenses in interest-free installments.

BNPL solutions in South America

Credit card penetration is low in most LatAm markets – creating a ripe environment for the growth of BNPL as an alternative. With a long history of installment payments for retail purchases that even pre-dates the internet, today more than 45% of e-commerce payments in LatAm are made via installments.

The majority of BNPL startups focus on Gen Z consumers, but South America is also full of interesting BNPL payment methods for other segments. Here are a few of the top names:

- Addi. This Bogota-based startup raised $140 million and doubled its valuation in the latest funding round, attracting the most renowned VC companies from Silicon Valley and beyond. Addi currently operates in Brazil and Colombia, planning an expansion to Mexico in 2022. Consumers can use the Addi platform and app to make purchases with just a few clicks and pay for them over three months at no cost. For larger purchases, Addi allows settling the bill up to 24 months.

- RecargaPay. Headquartered in São Paulo, RecargaPay counts 10 million wallets, creating an ecosystem of payments for millions of its customers. RecargaPay has also integrated consumer loans into the BNPL ecosystem, offering consumers the option to pay for energy and water usage in up to 12 monthly installments.

- Swap. Swap has recently launched a white label solution for BNPL platforms in Brazil. Swap uses the Mastercard network and single-use virtual cards to increase acceptance by retailers. The provider makes sure that consumers use credit for specific purposes using its multiple balance and shared authorization solution.

BNPL solutions in Australia

Australia has been one of the fastest adopters of BNPL solutions. Today customers pay for around 8% of all e-commerce transactions in installments. This volume is expected to grow to about 17% by 2023.

These leading BNPL solutions take a large chunk of the Australian market, and have also moved into other parts of the world – particularly North America:

- Afterpay. The top player on the Australian BNPL scene, Afterpay recently shared that its quarterly sales grew by 123% in comparison with the previous year. This international payments platform has gained traction across the United States and Australia, allowing its 10 million consumers to receive products immediately, pay via 4 interest-free installments, and get rewarded for paying on time.

- Zip. Another BNPL giant, Zip is now available in Australia, New Zealand, South Africa, the US and the UK. Zip offers an app that lets users create a virtual card and use Apple or Google Pay to pay in-store. Customers can create a single-use virtual card for online shopping and pay in weekly, fortnightly, or monthly installments with zero interest. Zip comes with a monthly account fee of $6, but this is only charged if the user has an outstanding balance at the end of the month.

Payment Solutions

Payment Solutions Services

Services Products

Products Industries

Industries Resources

Resources About PayU

About PayU