Learn more

Visit our resource hub for more on e-commerce, fintech, and financial inclusion trends in emerging markets.

See resource hubSouth Africa, Kenya, and Nigeria lead Africa’s rapidly growing e-commerce sector.

E-commerce has boomed everywhere over the past year – so what about Africa, with its fast-developing economies, rising internet penetration, and favorable consumer demographics?

Even before the COVID-19 pandemic, e-commerce in Africa was on an upward trajectory, driven by growing smartphone use and young, technologically-savvy populations. The corresponding rise of mobile commerce and other mobile-first solutions has fueled the growth of a vibrant digital ecosystem that has been unleashed at an even faster pace in light of the events of the past year.

In The Next Frontier, PayU’s report looking at growth in digitization and e-commerce across 19 global emerging markets, we explore the e-commerce picture in South Africa, Kenya, and Nigeria – three of Africa’s leading e-commerce markets all at different stages of growth. Combining external information with primary data from PayU’s global payments platform, we take a deep dive into the numbers to examine opportunities across four key African e-commerce sectors.

Scroll below the image to read some of the key insights on e-commerce in Africa – and fill in the form at the bottom of the page to download our full report.

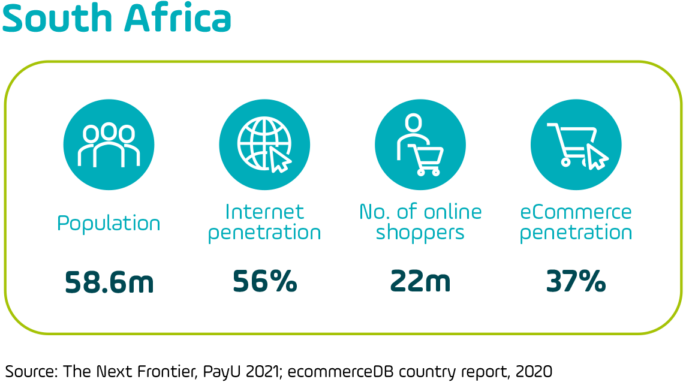

South Africa is Africa’s third largest economy and has long been a major driver of e-commerce across the continent. The country underwent one of the world’s most rigorous lockdowns during the first wave of the pandemic, and after some initial growing pains, e-commerce in South Africa advanced to new heights.

E-commerce spend on education boomed across South Africa in 2020, with a year-on-year increase of 67% on our platform in 2020. Beauty and cosmetics was another key segment, with the second-highest average transaction value (USD $67 per order) across all of PayU’s EMEA markets. Average transaction values in the education sector also rose significantly, from USD $136 to USD $404.

Mobile commerce continues to be a big part of the e-commerce picture in South Africa, with as many as 85% of transactions on our platform completed via mobile devices during the height of lockdown. As smartphones continue to become more widespread, mobile will be the key channel for reaching a new wave of South African e-commerce consumers.

Although South Africa is one of Africa’s richest economies, the e-commerce market still has significant room to run. Internet penetration remains only a little over 50% in South Africa, with e-commerce currently reaching just over a third of South Africans.

With nearly 60 million citizens, South Africa would be among the largest European countries by population. E-commerce merchants looking for under-the-radar growth markets with significant consumer potential and growth prospects should consider this fast-changing marketplace.

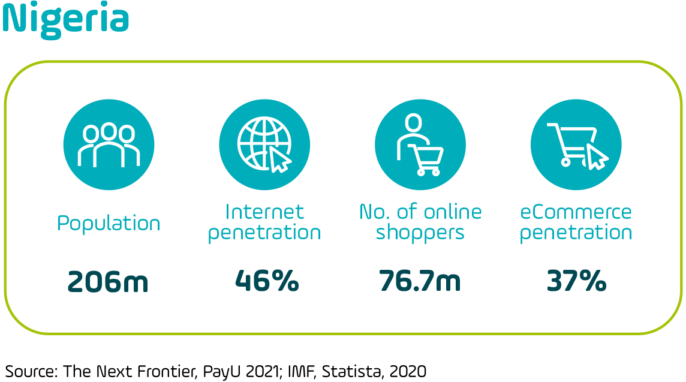

With the new African Continental Free Trade Area (AfCFTA) agreement, which enables improved business reach into new markets, the African market is taking steps toward becoming increasingly integrated. Within this context, Nigeria is a market with even more significant e-commerce potential in the coming years than it might have had already.

On its own, Nigeria is already Africa’s largest business-to-consumer e-commerce market, both in terms of number of shoppers and revenue. The sheer size of the market, along with high smartphone penetration as well as a young, increasingly urban population, combine to make Nigeria enticing for any e-commerce merchant captivated by the emerging African marketplace.

The digital goods segment is a significant source of e-commerce growth in Nigeria, with revenues in this vertical projected to reach nearly USD $1 billion by the end of 2021. Core e-commerce sectors like Beauty and Cosmetics also perform well, with $255 million in anticipated spend. Online fashion sales in Nigeria are projected to cross USD $2 billion this year.

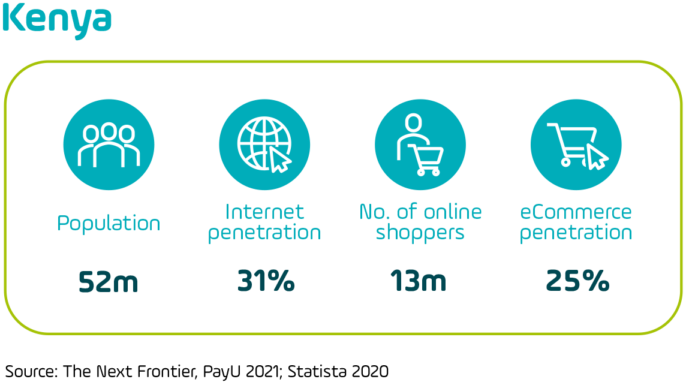

Of the three African e-commerce markets surveyed in our report, Kenya is unquestionably the least mature. With this said, “up-and-coming” could be an appropriate term to describe e-commerce in Kenya, with significant growth across core sectors like fashion (+160% between 2019 and 2021), as well as digital products and services (+94% over 2019 levels).

Despite a year of big gains, Kenya still has significantly lower internet and e-commerce penetration compared with South Africa and Nigeria – but a population only slightly smaller than South Africa and GDP per capita which is almost equal to Nigeria’s. This gap reveals a significant opportunity as Kenya adds more internet users and e-commerce becomes more prevalent.

With financial inclusion also outpacing digital penetration by a wide margin (financial inclusion in Kenya stands at 83%, up from less than a third in 2006), conditions are favorable for a sustained boom in Kenyan e-commerce over the coming years. A range of fintech innovations are now expanding access even further – further evidence that when it comes to the e-commerce market in Kenya, 2020 was only the beginning.

Learn more about the digital landscape across Africa and other emerging e-commerce markets.

We also provide insights on the local payment ecosystem, leveraging our experience as a leading payment technology platform offering merchants a single global solution for emerging as well as established markets.

Fill in the form to download our report and learn more about the e-commerce landscape in some of the most exciting growth markets around the world.