Further reading

Visit our Insights page for more on the e-commerce, fintech, and financial inclusion landscape in emerging markets.

Go to Insights overviewThe Beauty and Cosmetics segment has been a major driver of the e-commerce boom in emerging markets. Part 1 in our upcoming series.

The boom in e-commerce sales over the past year has led to new possibilities – some driven by necessity – for merchants everywhere. But the fastest growth in e-commerce by far has come from emerging markets, where underlying trends in digitization and the growth of online sales have been accelerated by the seismic shifts in retail fueled by the COVID-19 pandemic.

As the world looks forward to a post-COVID equilibrium, the expansion of e-commerce in emerging markets will be a major driver of growth and economic recovery in the years to come. From Eastern Europe to Africa, Latin America, Southeast Asia, and beyond, emerging markets are a land of opportunity for high-growth merchants as more and more customers in the world’s fastest-growing economies get comfortable with shopping online.

That’s why we created the The Next Frontier report, bringing together the perspectives of local PayU experts from around the world to provide insights into e-commerce growth across four key sectors in 19 emerging markets. In addition to the perspectives of local leaders from across our organization, The Next Frontier report combines external reports with the latest data from PayU’s payment platform, presenting an in-depth picture of the e-commerce landscape across our key markets.

Today we take the first of four deep dives into the key market sectors covered in our report – exploring the state of play in the Beauty & Cosmetics segment, one of the fastest-growing e-commerce verticals worldwide and a major driver of online sales growth across several of the planet’s most promising up-and-coming e-commerce regions.

While Beauty and Cosmetics is growing rapidly across nearly every emerging e-commerce market, Latin America has been at the forefront, showing an increase of 133% in category spend on PayU platforms in 2020. External analysis shows that total predicted online spend on beauty and cosmetics across Latin America is expected to reach USD $4.3bn in 2021, up from USD $3.8bn in 2020.

Although external data in our report showed a dip in total spend (both online and offline) on Beauty and Cosmetics in 2020, the proportion of sales made via e-commerce channels is increasing, creating many opportunities for merchants. Between 2019 and 2020, PayU saw total year-on-year online spend in Mexico increase on our platform by 1410%. Brazil was also up 1276% on 2019 levels.

In Colombia, PayU’s hub in Latin America, while external data showed a dip in total spend on beauty and cosmetics overall in 2020, the amount spent via e-commerce channels increased by 19%. Across our own platforms we noted an increase in spending far exceeding this pace of change, showing an average year-on-year spending increase of 70% between 2019 and 2020.

Throughout Latin America we onboarded a high percentage of beauty and cosmetics specialist merchants in 2020, showing the huge demand for buying beauty products online and the need for local merchants in this sector to adapt to new retail conditions.

E-commerce sales in Beauty and Cosmetics have also grown rapidly in Turkey over the past year-and-a-half, with over half of all sector spend in 2021 and beyond now expected to take place online. Of the four sectors we investigated, Beauty and Cosmetics benefitted from the largest year-on-year increase in consumer spend on the platform of Iyzico, PayU’s payments partner in Turkey (229%).

This was the largest increase across all six EMEA markets we explored, with the biggest increase coming last year in Q2 (392%) versus the same period in 2019. According to external data, by the end of this year average year-on-year e-commerce spend in Turkey’s Beauty & Cosmetics segment is projected to have grown by 80% since 2019.

Though not quite at Turkish levels, the online Beauty and Cosmetics sector is also growing quickly in South Africa, and is expected to be worth more than USD $169m by the end of 2021. This amounts to a 69% increase on 2019 e-commerce expenditure, which stood at $100m.

According to the PayU platform, year-on-year spend in Beauty and Cosmetics grew by 140% between 2019 and 2020. Spending particularly ramped up in Q3 2020, increasing by 229% compared to the same period in 2019.

It’s easy for e-commerce in Central and Eastern Europe to be overshadowed by the big markets in Western Europe, namely France, the UK, the Netherlands, Germany. But as with e-commerce as a whole, much of Europe’s e-commerce growth will be driven by its emerging markets in the years to come, supported by rising incomes, growing consumer familiarity with online shopping, and key public sector initiatives around digitization and payment security.

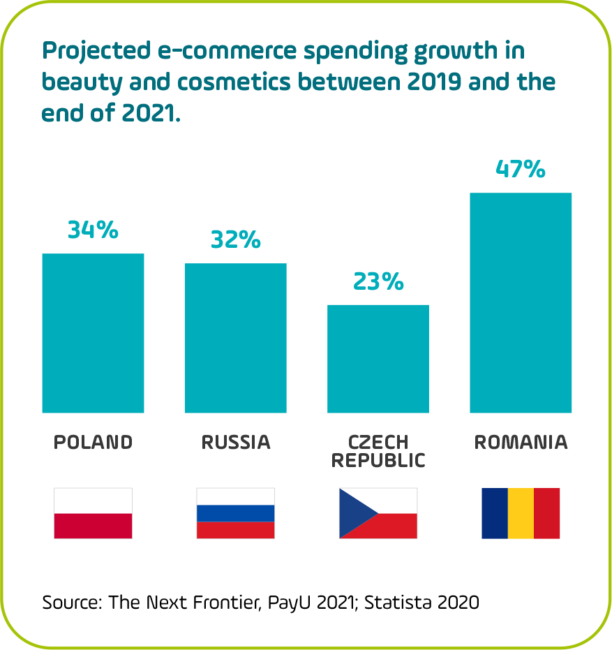

External data highlights the plethora of opportunities for Beauty and Cosmetics retailers in Romania, which has the European Union’s 6th largest population and one of its fastest-growing e-commerce markets. Romania’s projected e-commerce growth of 47% in Beauty and Cosmetics spend by the end of 2021 is bettered only by Hungary (49%) in the region. Total spend on Beauty and Cosmetics products is expected to reach $190m by the end of 2021, indicating a long road of growth ahead. Though Romania has a lower GDP per capita than richer Eastern European markets like Poland and the Czech Republic, Romania’s average transaction value of $70 in Beauty and Cosmetics was the highest of all the EMEA markets we analyzed.

As in other regions, we have consistently seen faster growth in the Beauty and Cosmetics segment reflected in PayU’s platform data compared with the overall figures. While external data shows a 7% increase in spending on Beauty and Cosmetics in Poland between 2019 and 2020, data from PayU’s platform shows a far greater increase of 81% in year-on-year spending over the same time period. This is partly attributable to the number of new merchants that were onboarded in 2020, but it also provides a more in-depth picture of the development of the e-commerce landscape as a whole.

Overall, the chart below shows how much of the growth in e-commerce across key Eastern European markets is being driven by Beauty and Cosmetics. As a relatively high-value sector with products that are easily sold online, it is likely that Beauty and Cosmetics will continue to play a leading role in the continued growth of Eastern European e-commerce sales figures over the coming years.

In addition to further insights on Beauty and Cosmetics, The Next Frontier report covers e-commerce developments across Fashion, Education, and Digital Goods within key markets across Eastern Europe, Latin America, India, Africa, and Southeast Asia.

We also provide insights on the local payment ecosystem, leveraging our experience as a trusted provider of payment technology and features that offers merchants the best conversion rates in emerging markets.

Fill in the form to download our report and learn more about the rapidly emerging e-commerce landscape in the some of world’s most exciting regions.