03/03/2022

II. Platform capabilities

4. Which payment methods does the provider support?

Payment methods coverage is a key aspect to consider when choosing the right payment provider for your business. Today the capability to offer a wide range of global and local online payment methods has become a key aspect of localization and meeting customers where they are. The right payment provider should ideally be able to offer a broad scope of payment methods to suit the needs and preferences of customers in any market.

5. Which payment optimization features does the provider offer?

Check if the company has any features that help merchants achieve higher approval rates and optimize payment traffic. While the topic of payment approval rates may seem mundane, a small change in the percentage of accepted payments can represent tens or even hundreds of thousands of dollars worth of revenue depending on the size of your business.

Here are a few examples of payment optimization features to look out for, which can help you get more out of your payments:

- Smart payment routing. This feature allows merchants to optimize payment traffic by creating custom rules that direct payments via different processing providers depending on a set of pre-determined criteria. A good routing engine will allow you to optimize for a variety of criteria, such as minimizing fees, maximizing approval rates, or limiting false declines.

- Instant retry. With this feature, merchants can automatically “retry” declined payments using another provider, in order to recover lost revenue.

- Advanced analytics. Having a centralized dashboard allows merchants to track KPIs and get a better idea of the opportunities for optimizing payments, as well as the impact of payment traffic on the bottom line.

6. How granular is the provider’s error fidelity?

Error fidelity is a measure of how precise transaction decline messages are. Transactions can fail for many different reasons, so it’s important that when your payment gateway declines a transaction, the decline message offers enough detail that you can fix it in the future (or in the best case scenario, that the customer can try again using another payment method). You can increase the likelihood of successful payment collection by customizing the collection attempts based on the exact decline reason.

7. Does the payment provider’s platform process chargebacks smoothly?

Chargebacks are a common element in the life of every retail business. Make sure that the provider can process them automatically for the smallest possible fee.

8. How advanced are the provider’s reporting and reconciliation capabilities?

A good payment platform should be able to provide a combination of standardized and customized reporting options that can help you to gain a real-time overview of your payments and their impact on your business.

Here are a few examples of how good payment reporting can make a difference:

- If you’re a subscription business, you depend on information from multiple sources, including external parties like payment gateways, banks, and credit card companies. To run your business smoothly or tell a compelling story to investors, you need to understand how this information is generated.

- Some businesses rely on reports from payment gateways, while others hire specialized internal staff who prepare reports using raw data from the gateway. If you know that you need more advanced reporting tools, ensure that the platform you pick can provide you with that – and be sure to ask at what cost.

- Do your payment reports allow for non-standard or customized reporting? Are there any additional fees or other considerations for creating or receiving non-standard reports? The ability to run custom reports is an important part of any payment platform’s reporting capability.

- How are the reports accessed – via download or on-demand? And how often can you generate them? If reports are difficult to generate, your reporting processes will be affected.

- Does the provider offer tools to search and find items? For example, duplicate or missing transactions? Straightforward methods for finding data improve the reconciliation process.

9. What does the payment provider offer in terms of credit card portability?

You may want or need to switch to a different payment gateway provider at some point in the future.

To help prepare for this change, find out what tools or support the provider offers to import and export customer and credit card information. You should also determine if there are fees involved in this process and how long it will take.

Whenever a business decides to change gateways, they’ll need to export their credit card data from their old gateway. Since this information is sensitive, payment gateways can be resistant to exporting the data. It can take months to schedule and cost a lot in professional services fees. You may lose access to legacy data and you might need to reconfigure your subscriber data.

10. Can the provider help with tax compliance?

Tax compliance is another important area to consider when picking the payment gateway. Tax rules and regulations can be very complicated and may differ by jurisdiction. Some countries also charge taxes on sales or purchases that other countries may not. Be sure to find a payment gateway that has local expertise and is familiar with the tax rules in all the areas in which you plan to do business.

11. How does the provider improve customer experience?

While payment approval rates refer to the percentage of accepted payments after the point of conversion, a good payment provider can also help to shepherd customers through the checkout experience. Many payment gateways include features to help merchants boost the customer experience and increase checkout conversion rates.

Merchants looking for ways to reduce cart abandonments can start with optimizing their checkout experience. According to the Baymard Institute’s yearly report on cart abandonments, nearly 20% of consumers abandon their shopping carts because of an overly long or complicated checkout process.

Find out whether your prospective payment provider can support a checkout experience that suits your business and most importantly the needs of your customers. A high-quality platform may offer out-of-the-box templates for the payment page and should constantly be improving them from a UX perspective to provide the best customer experience.

Don’t forget to ask about mobile optimization. Is the payment provider flexible enough to support the solutions you are looking for? The company may not allow full customization, but if it requires you to have software developers writing code, that might not suit you.

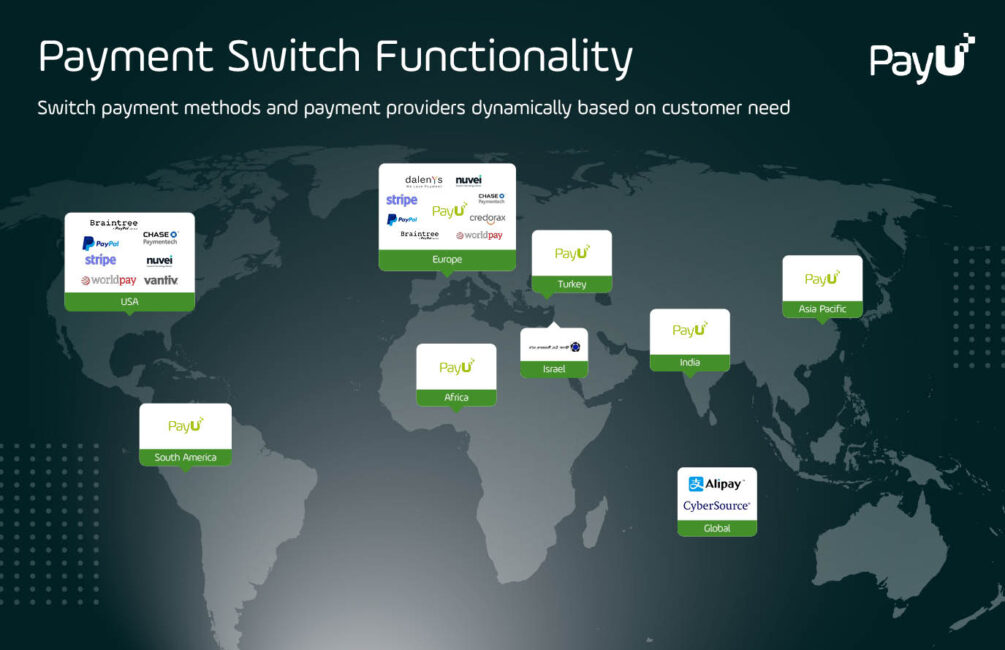

12. Does the provider offer a payment switch option?

One payment feature which can help to improve the checkout experience and enhance conversions is the ability for the payment gateway to “switch” payment providers depending on the transaction.

Payment switch functionality facilitates the communication between different payment providers at both the front and back end of a transaction. It can be used to offer customers a larger selection of local payment methods in different regions, while at the same time allowing for more efficient routing and transaction processing after the customer has already completed checkout.

A payment gateway offering payment switch allows for merchants to connect to a wide range of payment providers and payment methods using one global integration.

Payment Solutions

Payment Solutions Services

Services Credit

Credit Resources

Resources About PayU GPO

About PayU GPO