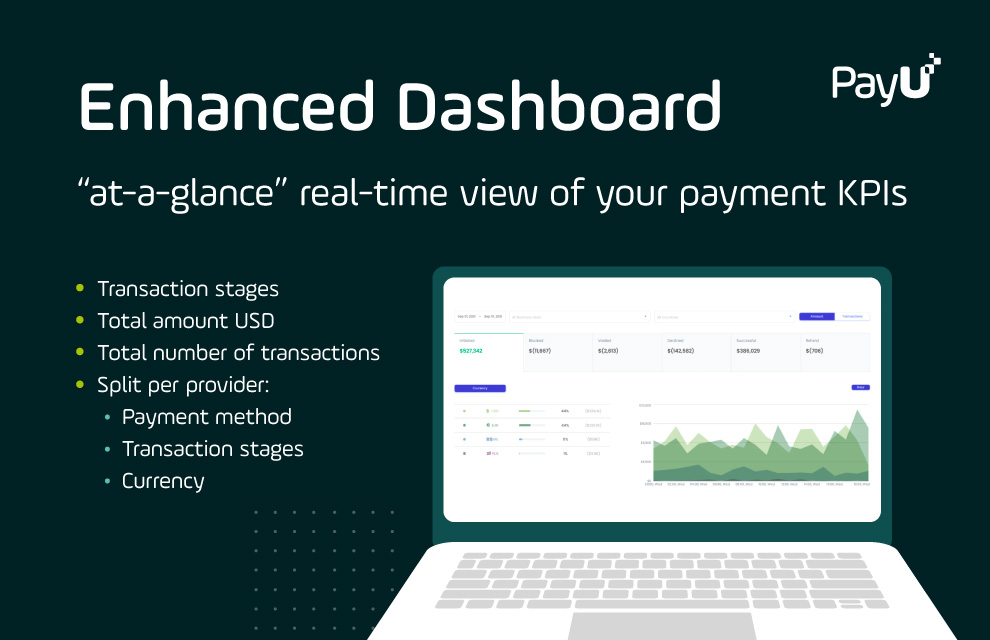

Advanced Analytics

Leverage real-time analytics to optimize every stage of the payment journey.

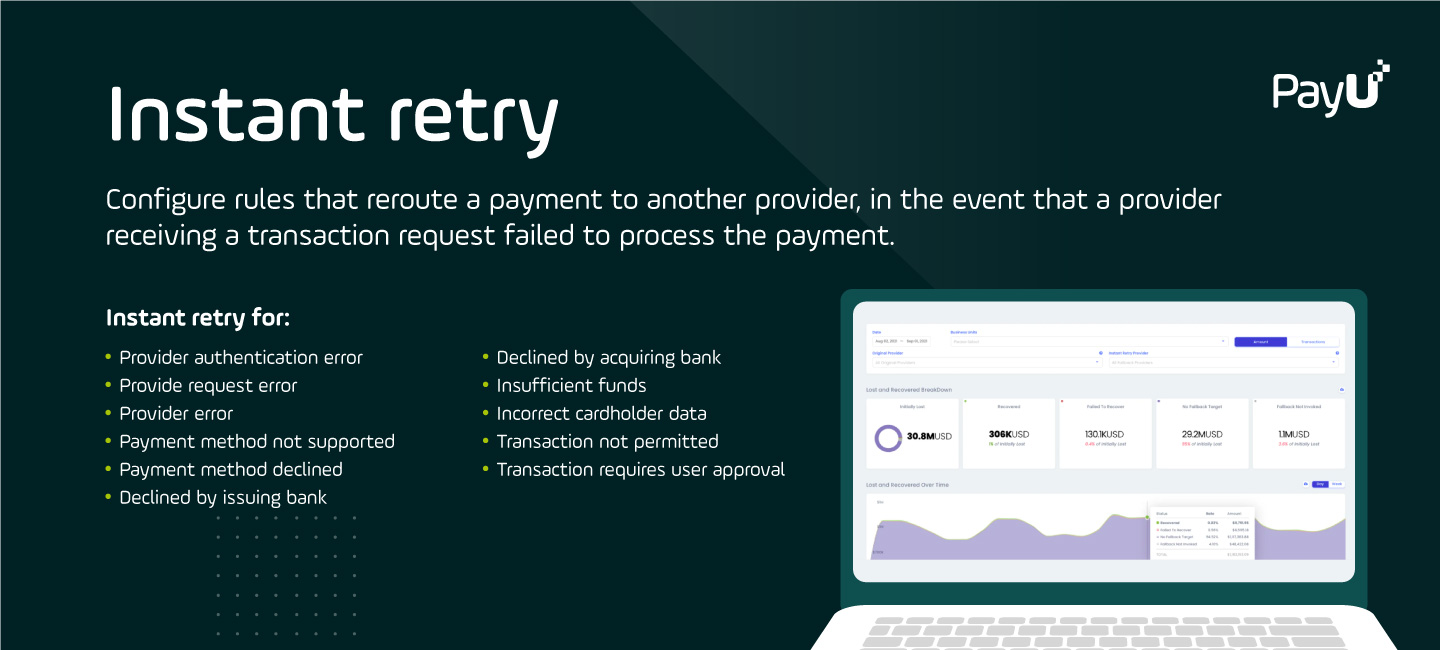

Learn moreConfigure rules that re-route a payment to another provider, in the event that a provider receiving a transaction request fails to process the payment.

The Instant Retry tool, a unique capability available through PayU’s global payment orchestration platform, saves failed transactions by re-routing them through a set of pre-configured routing rules.

Merchants use the PayU Decision Engine for quick setup, and can modify retry criteria according to specific error codes, card-country, and other factors.

The result? Businesses can improve approval rates by recovering failed transactions which would otherwise be lost due to false payment declines.

Instant Retry enables merchants to configure rules that instantly re-route a payment to another provider, if a provider receiving a transaction declined it due to technical or financial reasons. This feature helps you to automatically recover revenue that may otherwise have been lost due to a decline.

PayU’s Instant Retry feature provides an advanced dashboard for reviewing retried payments and their success rate. Configurable retry criteria allows for initiating Instant Retry based on specific decline reasons only, giving payment managers more control over when and how to re-initiate failed payments.

Instant Retry is a key component of PayU’s Smart Routing capabilities, part of our portfolio of payment optimization technology. Retries are set up to recover transactions that have been lost due to technical issues or financial declines. Rejections due to 3D Secure can be remediated via technical error configurations, while financial declines can be recovered through issuer-declined authorisation requests.

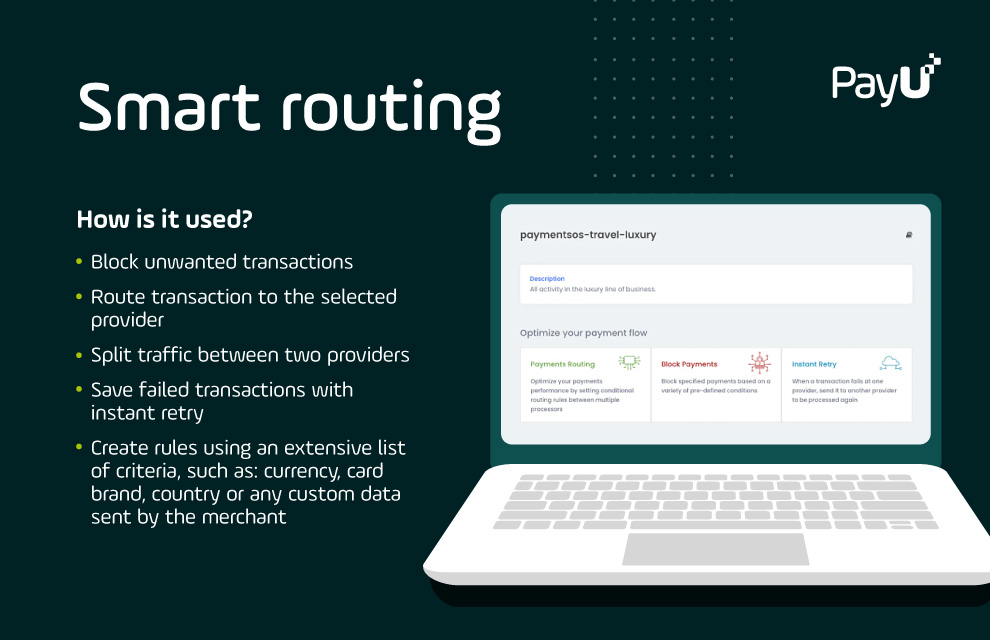

As two of the main features available through PayU’s Decision Engine, Instant Retry and Smart Routing have been built to provide merchants with the ability to build alternative routing methods in order to maximize payment approvals, prohibit undesirable transactions, and improve the efficiency of your global payments.

Leverage real-time analytics to optimize every stage of the payment journey.

Learn more

PayU’s AI-based routing engine deploys US-patented technology to optimize payment flows.

Learn more

PayU includes a range of features to help ensure secure payments – and peace of mind.

Learn more