27/10/2022

Credit and debit cards

In Europe, it’s very common to pay with credit or debit cards for online purchases. However, one can note significant differences among the countries when it comes to card adoption and usage.

For example, in the Netherlands, credit cards aren’t very popular because more than half of Dutch consumers use their national payment method, iDeal, for online purchases. In Germany, on the other hand, many consumers prefer to pay by invoice, digital wallets, or direct bank transfers.

Even in countries where cards are popular, the market tends to include a lot of local players. In order to ensure maximum payment method coverage, merchants should ensure they are able to offer plenty of card options from local issuing banks in addition to the global brands.

PayPal

Another holdover from the early days of e-commerce, PayPal has continued to innovate and remains on the leading edge of payment trends. PayPal has its own line of products and services that are incredibly popular around the world. Recent data from PayPal shows that senior citizens were its fastest-growing segment on a global scale in early 2020.

What’s unique about PayPal is that it has the scope and brand recognition to offer a comprehensive package of payment services, while financial technology companies in Europe still tend to focus on a particular service.

Europe has yet to see super-apps such as AliPay dominating the payments landscape across the continent or even in just one country, making globally recognized alternative payment methods like PayPal especially important.

Blik

For merchants interested in entering the dynamic Eastern European e-commerce ecosystem, Poland is a great place to start. With a population the size of Spain, rising wealth, and a growing online consumer base, the country is full of e-commerce opportunities. Still, merchants must be prepared to adapt e-commerce customer experiences to the local market. One place to start is by understanding which local payment methods are important in Poland.

Blik is currently the most popular mobile payment method in Poland. The system is embedded across multiple banking applications, covering all major Polish banks. As a result, more than 90% of all customers of Polish financial institutions can use Blik in mobile banking applications.

How does Blik work? When a customer proceeds to the checkout page, they can choose Blik from the list of available payment methods. Their mobile banking app then generates a code which the customer can enter at checkout. After the user clicks to pay, all he or she needs to do is confirm the payment in their mobile banking app.

This mobile payment method is convenient, fast, and easy to use. Blik is currently used only in the Polish market, but its popularity indicates a bright future across the continent.

Klarna

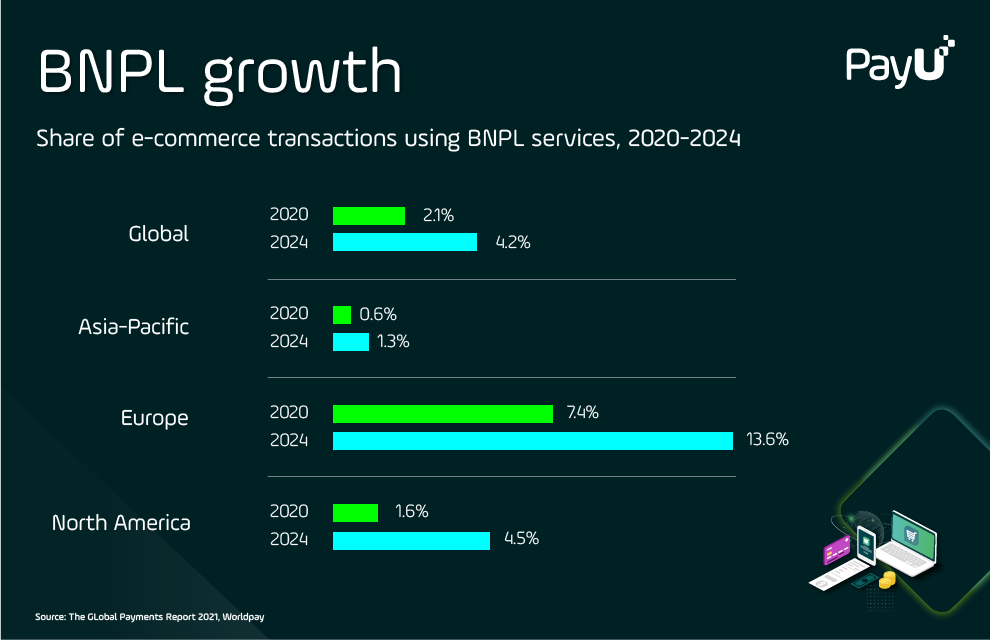

As noted, the $100 billion BNPL industry has seen the greatest levels of consumer adoption across Europe – especially Sweden, Germany, and the UK. Klarna is a Swedish online payments company and the most highly valued private fintech company in Europe.

It offers a Buy Now Pay Later (BNPL) solution consumers can use to purchase goods online with payment plans, as well as social shopping and personal finances.

To date, over 200,000 merchants have implemented Klarna both online and in-store. The solution is active in 24 European countries and has 99% coverage of banks in those markets, processing more than 150 million transactions per year. Klarna’s open banking solution allows third-party providers to simplify consumers’ access to their bank account data via Account Information Service (AIS) and Payment Initiation Service (PIS) services provided under PSD2.

Giropay

A real-time online payment service based on inter-banking, Giropay also has a more established history in European payments, having initially become popular over a decade ago. Since then it has achieved milestones including more than 100 million euros in purchases and over 3.2 million transfers, with transactions totaling 185 million euros.

Giropay remains particularly popular in Germany, where customers can log into their bank by entering a PIN before completing the transaction, which increases security.

The solution uses the same environment as banking sites and requires no additional hardware on the part of merchants. Some German banks offer two-factor authentication (2FA), such as a challenge-response access token based on the chip embedded in the debit card or ATM card. Others offer simpler PIN and TAN-based online banking services. No sensitive information is shared with the merchant, such as credit card or Giro account numbers. Another advantage to merchants is that Giropay does not allow chargebacks.

While Giropay, like card payments, has seen increasing competition from alternative payment methods in recent years, its legacy position in the market ensures that it will continue to be an important payment method for the immediate future.

Payment Solutions

Payment Solutions Services

Services Credit

Credit Resources

Resources About PayU GPO

About PayU GPO