12/05/2022

Why are payment analytics so important? Consider the following example. By looking at analytics in South America, you may notice low conversion rates due to a large group of buyers who are unbanked. In doing so you may discover that this population of consumers requires more alternative payment methods in order to make purchases online. By implementing a more complete portfolio of payment methods, your business will eventually reach more people online.

Understanding your buyers’ preferences, market behavior and specific payment methods per market – all of these are key points provided by payment analytics.

What are some of the other key benefits of leveraging data from payment analytics?

Accessing end-to-end customer intelligence

Online merchants know the importance of having multiple data sources that – when brought together – paint a complete picture of the customer.

This has become an article of faith when it comes to customer acquisition and online marketing. Payment analytics simply applies the same thinking when it comes to optimizing transactions.

But payment analytics can also be useful when it comes to understanding customer behavior. For example, by combining payment data sets to get a full 360º view, merchants can understand their customers’ buying patterns and use this information to identify and reach out to first-time shoppers or those moving between channels.

Sometimes comprehensive data analytics opens the door to other insights – for example, when a shopper is likely to enroll in your loyalty program or what triggered that decision. It can also be useful for merchants to gauge the demand for Buy Now, Pay Later (BNPL) payment methods and other trends such as QR codes, loyalty-integrated payments, and Pay by Link (PBL).

To do this successfully, merchants need to consider a few things:

- Can you easily access all the payment data needed in your organization?

- Do your employees have the right tools and training?

- Do you have the right analytics to visualize this data efficiently across channels?

All are important when it comes to getting the most out of payment analytics.

Discovering payment trends among customer segments

Payment processing data can show you which payment methods your customers use most often to make purchases. While some regions are more card-friendly, others might favor local or alternative payment methods. You might use this information to tailor your local payment strategy to offer a wider range of payment method options at checkout.

The ability to accept payments across multiple banks in multiple locations worldwide allows e-commerce retailers to process local payment types and optimize conversion rates. That’s the value of a global payment solution.

But payment analysis and reporting can help you go a step further by reconciling data from multiple accounts as well as multiple currencies. If you’re operating on a global scale, you want to ensure you’re maximizing your payment conversions and minimizing cost. Based on the data in your payment analytics, you can develop a plan to expand your reach and support international customers better.

Understanding local payment types

If you’re a company that operates internationally, fraud alerts could be triggered when customers buy an item from your store using a credit card issued in their home country.

For example – suppose you’re a US-based retailer accepting a payments in the United States from a card issued in Europe. In that case, the issuing banks might look at the transaction history of the card owner, see that they live in Europe and do not typically shop outside of Europe, and decline the payment.

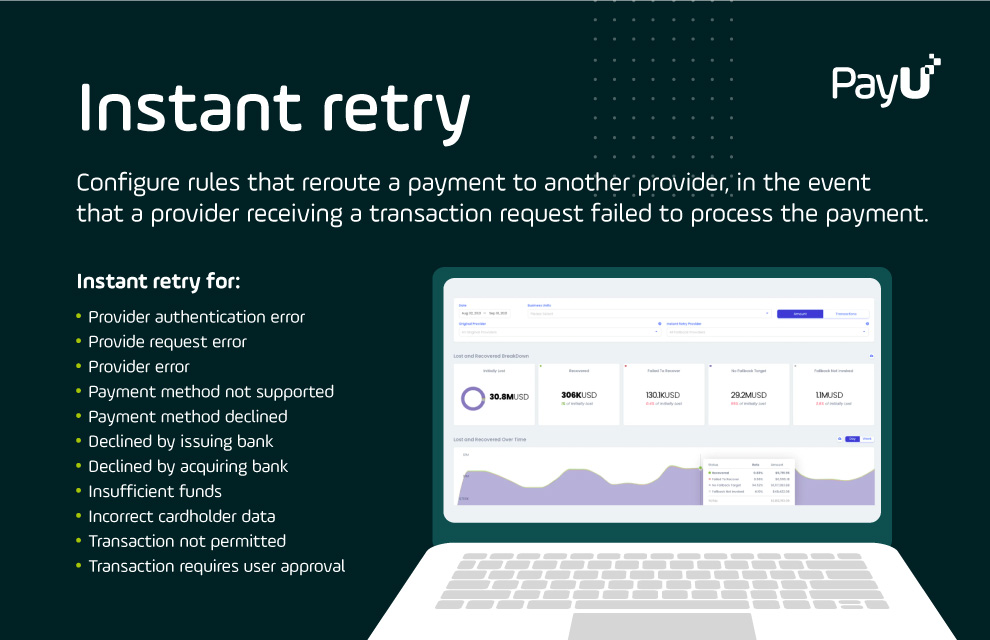

A good payment analytics solution, built into a platform with the right payment optimization capabilities, would flag this issue and help you to change the routing configuration if necessary in order to get the payment accepted.

Reducing chargebacks

Merchants should be mindful of chargeback rates, which can give a lot of insight into customer interactions. To help better understand chargebacks, payment processors have started offering chargeback management tools.

Using information from various data sets, merchants can leverage payment analytics to get a more well-rounded view of the customer experience – and take steps to reduce chargebacks.

Forecasting revenue and customer activity

Using historical data to analyze past trends and predict future outcomes are key components of being successful when it comes to doing business online. Thanks to real-time payment data, merchants can assess their situation and make informed decisions faster.

For example, if sales in one region are low due to competitive activity, merchants who may have been hesitant to offer discounts might create a special offer to entice shoppers for that specific region.

Measuring the impact of your marketing campaigns

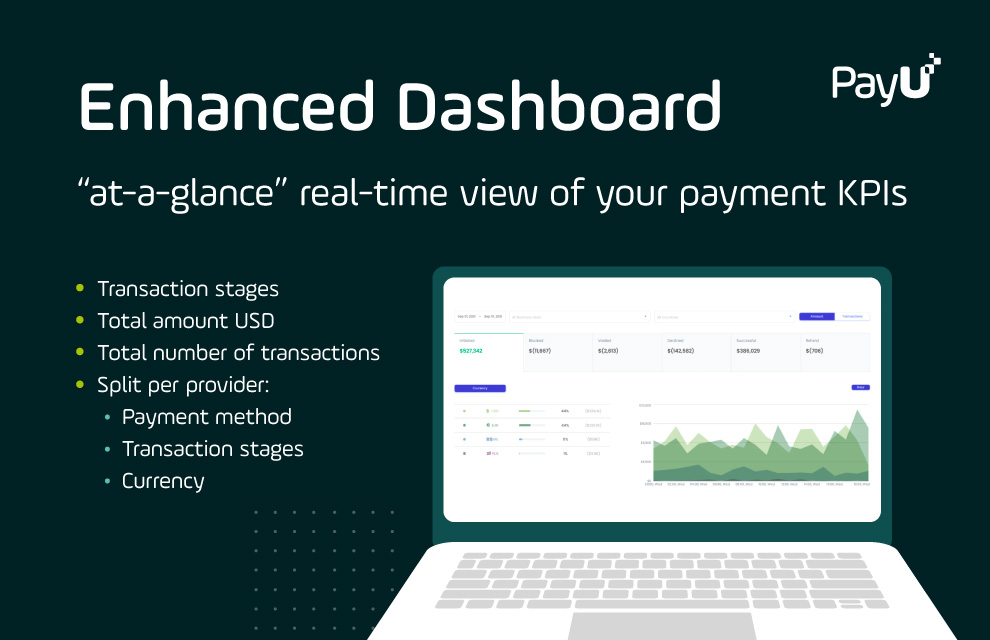

It’s critical for merchants to have analytic tools in place that allow them to customize intuitive dashboards and make relevant business decisions based on payment data.

Bear in mind that when evaluating which data to collect and visualize, different departments will want to see different things. Insights about consumers are most relevant to marketers who can see which demographics are buying which items or which stores are more profitable. This will help the relevant teams to refine their advertising campaigns and improve overall conversion rates.

Identifying minor issues before they snowball into big problems

Shoppers increasingly make purchases online and rely on reviews when deciding what products to buy. Online review platforms have made it easier than ever for customers to share feedback. If customers are unhappy about their shopping or payments experience, they may leave a negative review.

Looking at payment analytics data, merchants can identify problems with their payment systems before they affect customers. For example, you can discover erroneous payments or false decline activity and handle it before customers complain or take their business elsewhere.

In this way, analytics can act as a kind of “early warning system” helping merchants to stay ahead of potentially unforeseen problems with transaction flow. By setting up trend triggers to provide alerts when issues happen, businesses can take quick action to ensure a frictionless payment experience and continually happy customers.

Payment Solutions

Payment Solutions Services

Services Credit

Credit Resources

Resources About PayU GPO

About PayU GPO