11/11/2021

Maintaining – not to say improving – approval rates when scaling up can be a challenging task to manage. Merchants are constantly on the lookout for solutions and ways to increase their bottom line, scale their business seamlessly, and not lose business and sabotage their customers’ experience in the process.

Payment declines can result from many reasons— issuing banks are more likely to approve payments made in local currency/with a local acquirer. Some acquirers are subject to lower approval rates for certain card brands — so transactions performed with Mastercard, for example, might be declined by one acquirer and accepted by another solely due to algorithm differences. This ‘arbitrary’ decline/approval can be very frustrating to merchants.

As mentioned, a multitude of things can affect approval rates. Isolating the exact ‘issue’ can be challenging since the payment chain is complicated and multi-faceted. Still, insights and data analysis that scan the market’s behavior can help point out recurring behaviors and challenges that affect the chances of transaction approval— and that’s where optimization solutions come into play.

The Solution: Data-driven payment optimization

How can you battle market uncertainty and make sure you optimize your approval rates to the max?

Self-optimization is very challenging to perform. Decision-making should rely on data accumulated over long periods, from which you can then decide on the best action items for your business performance. Once you have the conclusions from a reliable data source, the actual ‘correction’ or adjustment of said deficiencies should be simple to perform. You also need to track your stack’s behavior once you’ve implemented said changes and be informed if there’s an anomaly.

All of these tasks are very time-consuming to maintain single-handedly. That is why you could benefit from an optimization solution that helps automate most of that process.

The PayU difference: How our merchants optimize best

PayU gives you all the tools to optimize your payments via our PayU payment orchestration platform. The orchestration platform combines optimization features that allow you to extract business data, devise routing rules, integrate with new providers, and optimize your payments in real-time, all thanks to AI-based payment optimization.

PayU orchestration platform’s optimization benefits stem from the following core pillars:

Let’s show how payment optimization is performed via the PayU platform with an example:

You discovered that one of your providers is performing poorly and declining a hefty amount of payments originating in Germany. A deep dive into your data shows a recurring ‘provider error’ generated for 11% of the transactions sent to this provider.

The solution thus enabled you to spot the decline reason easily with clear data visualization and aggregation.

Once you’ve spotted the problem, you can then move on to the next stage of changing the decision engine rules according to this new discovery. Our US-patented* Smart Routing Engine easily allows you to change the rules for payments generated in Germany to a different provider. You also have the option to a/b test several providers. You are the sole controller of your payments in this regard, and after you’ve devised new rules according to your exact requirements, you can then switch to the real-time dashboard and see how your payments perform in real-time.

Still not satisfied? No problem. You can change and optimize indefinitely until you are. The process is easily viewed, managed, and maintained— so you can rest assured you leave no money on the table.

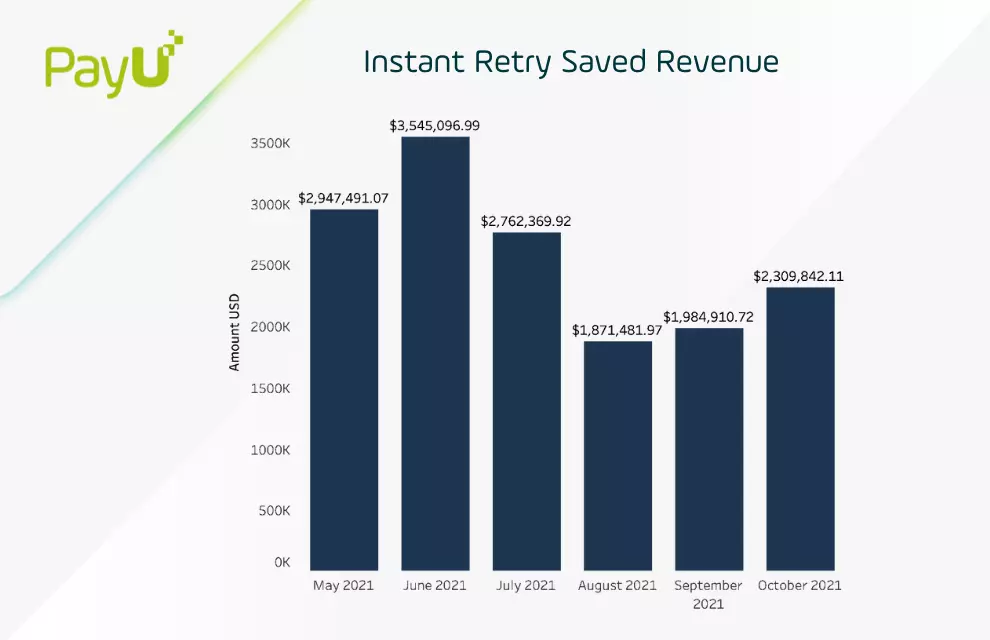

Another unique feature offered by the PayU orchestration platform is our Instant Retry feature. This feature lets you configure rules (via the decision engine) that instantly re-routes payments to alternative providers if a transaction is declined via Provider A. The routing rules associated with this feature can also be based on multiple parameters. This feature alone has a powerful effect on our merchants’ button line. The graph shows the revenue saved thanks to this feature for a group of 5 of our merchants over a specific time.

Payment Solutions

Payment Solutions Services

Services Credit

Credit Resources

Resources About PayU GPO

About PayU GPO