07/04/2022

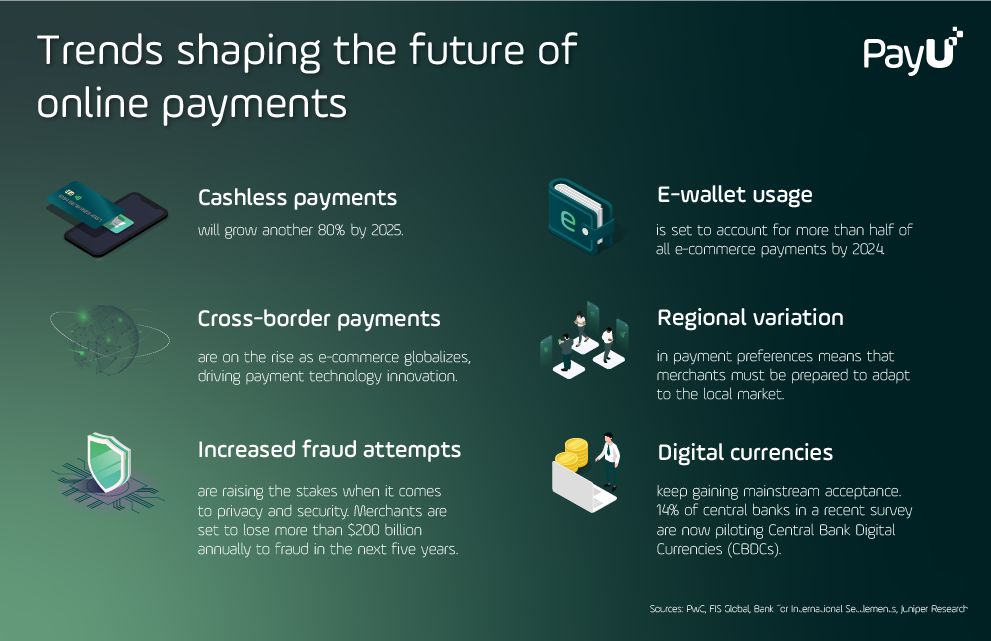

1. Continued expansion of cashless payments

The shift from cash and traditional cards and e-wallets is undeniable. Global volumes of cashless payments will increase by more than 80% between 2020 to 2025. This trend is only going to expand.

The Asia-Pacific region is set to grow fastest, with cashless transactions spiking at 109% until 2025. Consumers across Africa, Europe, and Latin America will follow with a relatively high growth ratio.

According to data from PayU’s payment platform in LatAm, 2021 saw an increase of 54% in transaction rate and a 32% increase in sales in 2021 as compared to 2020.

2. Regional variation in online payments adoption

Unsurprisingly, different online payment methods are seeing different rates of growth and uptake around the globe. While Southeast Asia is a booming market for e-wallets, consumers in Europe are more excited by installment payment options like Buy Now, Pay Later.

Merchants operating across more than one country need to adjust their choice of payment methods to the local standards, expectations, and needs. Meeting the payment needs of customers by offering a wide range of popular online payment methods is increasingly key to e-commerce success in new markets.

To manage the complexity of offering different payment methods across different markets, merchants are increasingly turning to advanced payment gateway options that offer a single, direct connection to popular global and local payment methods around the world.

3. The rise of digital wallets

Digital wallets (also called e-wallets) store payment methods and access funding sources such as cards or accounts. Usage of digital wallets is on the rise, with more to come as wallets are set to play an increasingly important role in the future payment landscape.

Transactions made through digital wallets will account for more than half of all e-commerce payments globally by 2024.

As the market changes, traditional payment providers will continue to engage in further collaboration with fintechs and technology providers to innovate in this area. And merchants will surely pay more attention to the digital wallet support offered by their payment providers of choice.

4. Digital currencies and tokens

Technological innovations including blockchain, cryptocurrencies, stablecoins, non-fungible tokens (NFTs) and central bank digital currencies (CBDCs) have been causing a stir in the online payment arena. Digital currencies are racing ahead, seemingly unaffected by the periodic crypto crashes.

A recent survey showed that 60% of central banks are now considering Central Bank Digital Currencies (CBDC), and 14% are already well underway with pilot tests.

Although cryptocurrencies were once stigmatized, they’re now widely accepted by many businesses as a legitimate means of payment. Many retailers who previously allowed only traditional payment methods are now open to cryptocurrencies.

Some industry players are already leading the evolution of payments towards digital currencies by developing integrations to enable cryptocurrency-based payment options. In doing so, they are creating new opportunities for e-commerce merchants and opening new doors for users to transact freely with the help of DeFI and blockchain technology.

5. Cross-border payments

Cross-border transactions have historically been slow, expensive, and time-consuming. At the same time, e-commerce is becoming more globalized by the day.

As a result, many industry players and businesses have been cooperating to rethink the future of cross-border payments and develop new methods to streamline international payments.

In the future, many nations will realize the need to establish government-backed digital currencies, which will, in turn, drive merchants to integrate solutions for streamlining cross-border transactions.

In the meantime, banks will continue improving their cross-border processes through APIs for faster real-time operations, with payment platform providers like PayU seeking to provide a more integrated experience that simplifies the complexity of cross-border payments and makes it easy for merchants to accept payments in any market.

Payment Solutions

Payment Solutions Services

Services Credit

Credit Resources

Resources About PayU GPO

About PayU GPO