23/08/2022

Credit card

Credit cards are still one of the most important payment methods in e-commerce. Most payment gateway technology supports the major global credit cards, but the situation becomes more interesting in local markets. In particular, local credit card issuers play an important role in the e-commerce landscape of many emerging markets.

Depending on the payment provider, card payments may come with relatively high transaction fees. Another common issue merchants face is the high payment failure rate due to lost and expired cards. This naturally results in lost customers and lost revenue.

Another challenge is the importance of safeguarding customer card data, governed by the PCI-DSS standard. This can result in heavy fines for merchants if not done correctly.

The right payment solution can help businesses process card payments more efficiently, while safeguarding customer data via tokenization, thereby lowering the merchant’s responsibility or “PCI scope” when it comes to handling customer card details.

Direct debit payments

Consumers find direct debits very convenient and merchants often use this online payment method to set up recurring automated payments. Any small business based on a subscription model benefits from this option.

The most significant advantage of direct debit payments is that payment is almost instant, so there’s no need to wait for customers to pay an outstanding invoice. This is also convenient for customers as they don’t have to approve payments when their debit card is used for recurring payments.

With direct debit, the payment provider automatically takes funds from the customer account once the merchant sets up the direct debit payment method.

E-wallets

An e-wallet or digital wallet is a type of software that stores information for different payment methods, along with other items such as boarding passes, gift cards, or driver’s licenses.

Accepting e-wallet payments reduces cart abandonment and increases trust, especially when using wallets with high brand name recognition, such as Google Pay or Apple Pay. In such scenarios, the digital wallet access uses the shopper’s device, potentially secured with facial IDs, thumbprints, and security codes. This leads to a lower risk of fraud for merchants.

To make this type of payment work, merchants need to accept the right wallet in each market, which is challenging given the number of wallets available worldwide.

Integrating with multiple e-wallets is often time-consuming and expensive. This is why many merchants turn to an all-in-one payment solution in order to accept e-wallets.

Mobile payments

Mobile payments encompass mobile wallets as well as mobile money transfers, helping merchants to offer an alternative way of paying for goods or services that is less expensive for businesses than accepting credit card payments.

Accepting mobile payments allows small business owners to make payments more convenient for customers. This payment method also opens the door to integrating loyalty and reward programs, serving as a great source of data for customer analytics.

Payment security is a key concern in this area, leading businesses to choose payment providers offering comprehensive mobile payment solutions.

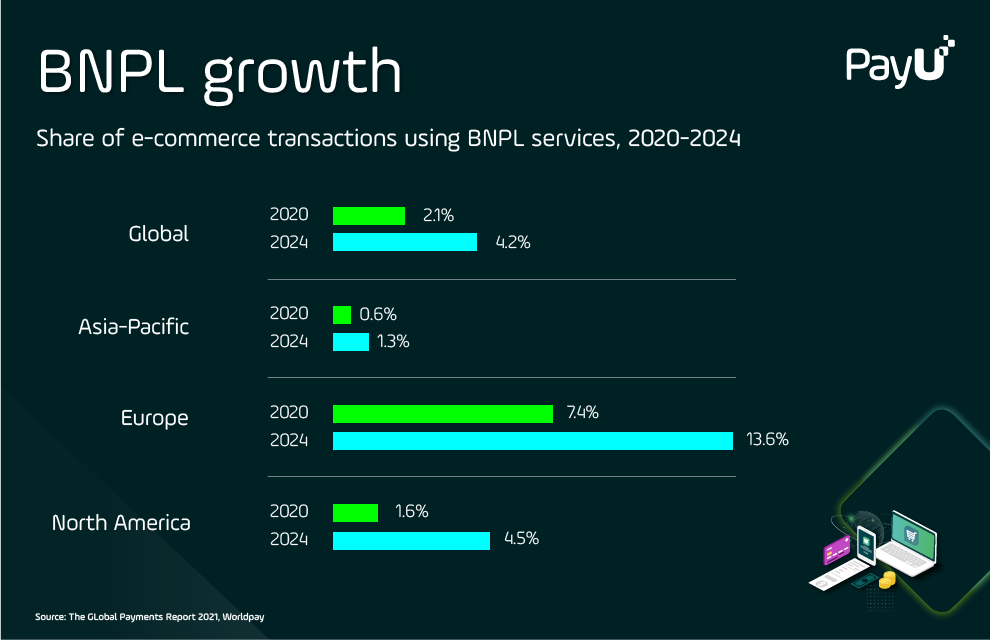

Buy Now Pay Later (BNPL)

BNPL payments allow merchants to be paid upfront before customers pay for the transaction. In this scenario, the provider fronts the transaction amount and takes on any risk of fraud or delay.

Because it can help customers to feel more comfortable making a larger purchase, BNPL usually results in higher transaction values and conversion rates at checkout. For longer installment cycles, BNPL models take advantage of predictive algorithms that provide instant credit decisions as part of the checkout process.

In many emerging markets, BNPL serves as a means of financial inclusion, enabling more people to participate in the digital economy. Of the more established global e-commerce markets, BNPL is particularly popular in Europe – especially in countries such as Germany, Scandinavia, Austria, Switzerland, and the Netherlands.

Payment Solutions

Payment Solutions Services

Services Credit

Credit Resources

Resources About PayU GPO

About PayU GPO