01/07/2022

1. Fast and secure payments

Having a dedicated payment platform helps merchants receive payments much faster than normal.

This means merchants can provide a better shopping experience to their customers and also get paid out faster, helping with cash flow.

By optimizing payment routing, merchants provide a faster payment approval process to the customer with fewer false declines (more on this below).

2. Cost-effectiveness

In recent years, global payment solutions have become more accessible to SMBs both in terms of cost as well as the ease of implementation.

PayU’s API for example allows even the smallest merchants to activate global payments in any market around the world through a single point of connection.

With pricing determined based on the size and needs of the business, combined with the potential to increase revenue and profit margins through payment optimization, SMBs can see a clear ROI when it comes to investing in advanced payment capabilities.

3. Optimal customer experience

Many businesses struggle with the problem of cart abandonment. One reason behind this can be a lack of preferred payment options. When customers don’t find their ideal payment method on the checkout page, they might think twice about making a purchase, or get distracted and leaving things hanging in limbo.

Another common factor when it comes to cart abandonments are slow payment approval times. If a payment takes forever to get approved, or asks for endless additional manual steps from the user, it can add friction and make the user less likely to follow through with their purchase.

Merchants that offer a variety of payment options along with faster and more secure transactions can drive better engagement with customers and improve conversion rates in their online store. By integrating the right payment gateway, any business can take the customer experience to another level.

4. Implementation and auto-onboarding

Auto-onboarding helps merchants to glide through the process of integrating a new online payment solution. This is all thanks to an automated process that counts just a few steps merchants have to follow online.

PayU offers auto-onboarding in select markets and provides other assistance to companies on a per region basis to make the process of getting started as simple and easy as possible.

With clear developer documentation and the support of a dedicated sales engineer, SMBs working with PayU have everything they need to implement a sophisticated global payment platform.

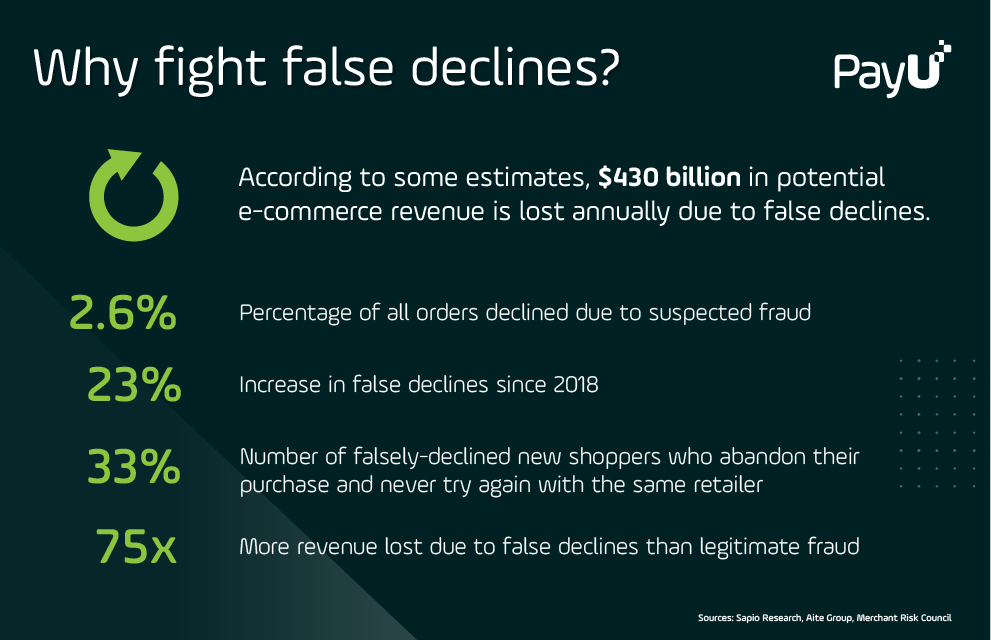

5. Reducing payment declines

Payment approval rates for e-commerce transactions average around 85% – significantly lower than the 97% average for in-store retail.

This is due to a variety of factors, one of which is the inherent difficulty of verifying identity and preventing payment fraud when a transaction is completed virtually versus face-to-face. As a result, many well-intentioned fraud filters mistakenly flag legitimate transactions as being suspicious or fraudulent. All of this adds yet another layer of friction to the consumer transaction, and results in billions of dollars worth of intended purchases which don’t get completed at all.

Increasing the payment approval rate and cutting down on false declines is one of the most powerful tools in a merchant’s arsenal when it comes to squeezing higher revenues out of e-commerce. Even marginal approval improvements of a few percentage points can result in tens of hundreds of thousands of dollars worth of additional turnover.

One of the most compelling reasons for SMBs to invest in a global payment solution is the capability to increase revenue by optimizing approval rates. With features like Smart Routing, which sends payments through the optimal payment routing configuration to improve approval rates and lower fees, as well as Instant Retry, which can retry a failed payment by sending it via a different provider, any SMB can benefit from the same tools for fighting false declines and boosting approval rates that are available to the largest global businesses.

Payment Solutions

Payment Solutions Services

Services Credit

Credit Resources

Resources About PayU GPO

About PayU GPO