13/10/2022

Offer the right payment methods

Merchants should always offer options that enable customers to purchase goods and services quickly and efficiently, regardless of where they are located.

Consumers appreciate a fast checkout process – as well as a familiar one. That’s why Beauty and Cosmetics merchants can improve conversion rates across domestic as well as international markets by providing a good mix of traditional and alternative payment method options.

Which payment methods should merchants offer? The answer depends on the local market – which is why merchants should consider working with a payment gateway that can provide a wide array of global and local payment method options.

What should merchants do in order to take payment methods seriously? This is one area where partnering with an expert can make a big difference.

Consider one of PayU’s clients – a leading global player in the Beauty and Cosmetics space. Over the past few years, the business has gone from processing almost no online payments at all to about 40% of its total business being done online. Having the right global payment provider helps this merchant ensure that it is offering the right payment methods to customers in different locations, without needing to be an expert in payment methods on their own.

The more relevant payment method options a merchant can offer, the more likely they are to appeal to a broader audience and deliver a seamless shopping experience for everyone. And while conventional payment methods like credit cards and bank transfers might reach a wide swath of consumers in some markets, in others they can leave a significant amount of potential customers on the outside.

Be where your audience is

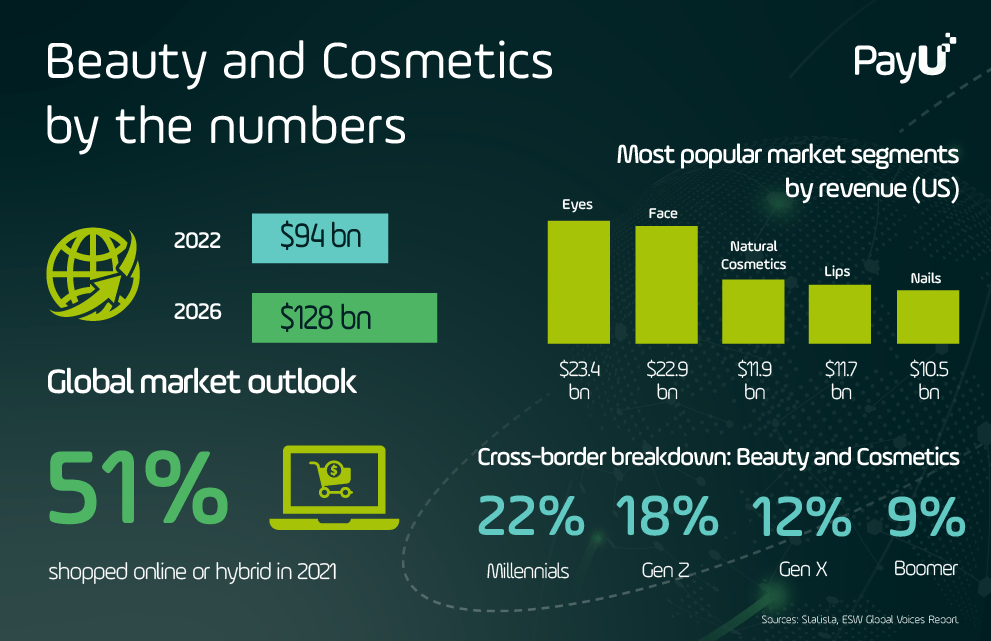

Beauty and Cosmetics products are available everywhere, starting from drugstores and brick-and-mortar stores to e-commerce sites, platforms, or social media channels. To increase conversion rates, merchants need to ensure that the payment experience is well-optimized and that checkout is just as user-friendly on mobile or desktop as it would be on any other selling channel.

One area that merchants should pay specific attention to: mobile commerce, which is especially relevant for Gen Z and Millennial customers. Unsurprisingly, these two generations convert via mobile more than any other generation.

Payment methods are a particularly important part of successful mobile commerce strategies. As part of an overall mobile-friendly user experience, the checkout process should be optimized for the device – for example, offering Apple Pay/Google Pay/Samsung Pay as an available payment method when users are browsing a catalog on a smartphone or checking new products on a tablet.

Reduce the need for reverse logistics

High return rates are another unfortunate – and largely unavoidable – challenge common to the Beauty and Cosmetics sector.

Beauty and Cosmetics is among the industries most impacted by returns rates, as 22% of cosmetics and health products are sent back to merchants.

How can merchants reduce return rates and lower the need for complicated and costly reverse logistics? The choice of payment system may not be the first thing that comes to mind, but it can help.

For example, PayU offers an instant refund service in Romania, a refund management feature in Poland, and functionalities such as partial capture and partial refund.

While this won’t prevent payments from being refunded altogether, fast or instant refund capabilities at least capture returns before they happen by preventing unwanted products from getting shipped out in the first place.

Process payments as locally as possible

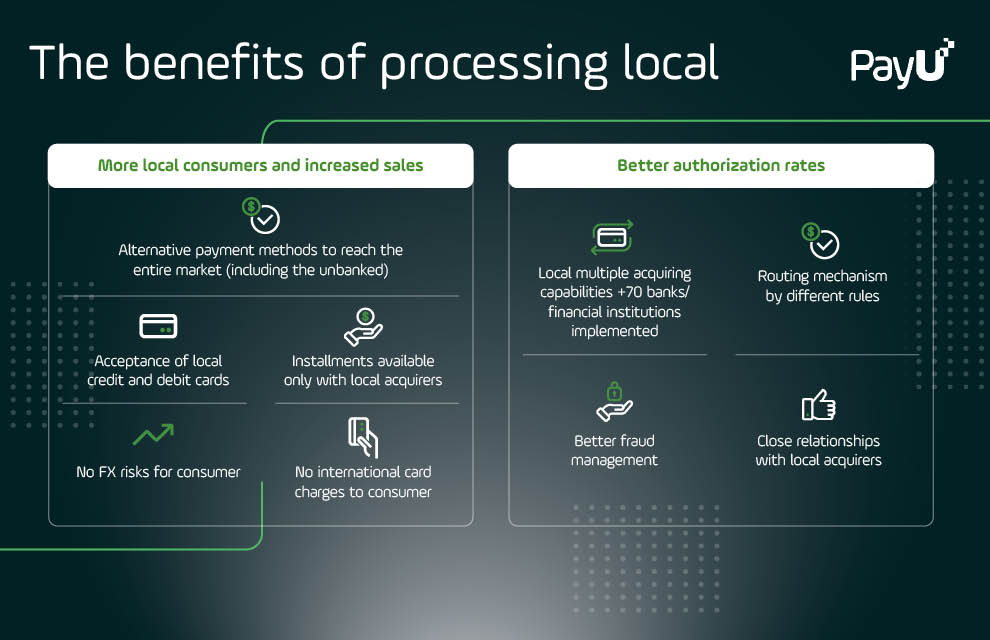

One key tactic that merchants can use to offer more local payment methods (and get more payments approved) is to acquire and process payments locally. Local acquiring is generally cheaper – and it’s required to accept local payment methods in the first place.

So why don’t more merchants do this already? There are a couple of reasons.

First, many online merchants start their expansion journey using off-the-shelf payment gateway technology. This can be helpful for getting started, but it usually only provides access to a handful of popular payment methods. Because the payment gateway doesn’t have the necessary payment acquiring relationships on a country-by-country basis, merchants can’t offer many local cards, bank accounts, or other important payment methods that are not supported by the payment gateway.

Merchants who wish to offer local payment methods or process payments locally in any given market can get around this by choosing to work with a local payment provider in that market – but this solution obviously doesn’t scale well.

To process payments locally on a global scale, merchants should look for a global payment solution that has acquiring capabilities in multiple local markets. Local acquiring is a cornerstone of PayU’s approach and is a must for companies that hope to do high volumes of business internationally.

Work with partners who understand the local market

One benefit of acquiring locally is benefitting from local knowledge and expertise. When starting cross-border operations, merchants need to get familiar with local regulations and develop a seamless checkout experience in line with buyer expectations, establishing processes to overcome logistics and shipping hurdles.

This is another area where the choice of payment provider can help merchants to navigate some of the more thorny issues.

By working together with PayU to grow and expand its online business in Latin America and EMEA, for example, a social selling beauty company operating across 60 markets has already unlocked over $100 million in total payment volume and witnessed a 35% increase in approval rates year-over-year in key emerging markets.

Payment Solutions

Payment Solutions Services

Services Credit

Credit Resources

Resources About PayU GPO

About PayU GPO