E-learning and online payments: Why the right payment technology matters

28/07/2022

Optimizing payment routing and the customer checkout experience are critical for any company doing business online. The same is true for EdTech and e-learning.

E-learning businesses must ensure that – at a minimum – their platform offers simple and easy online checkout capabilities, in order to minimize friction during the payment journey.

At the same time, to reach more customers and expand to new markets, EdTech businesses should focus on offering more online payment methods to further maximize conversions and meet a wide variety of consumer preferences.

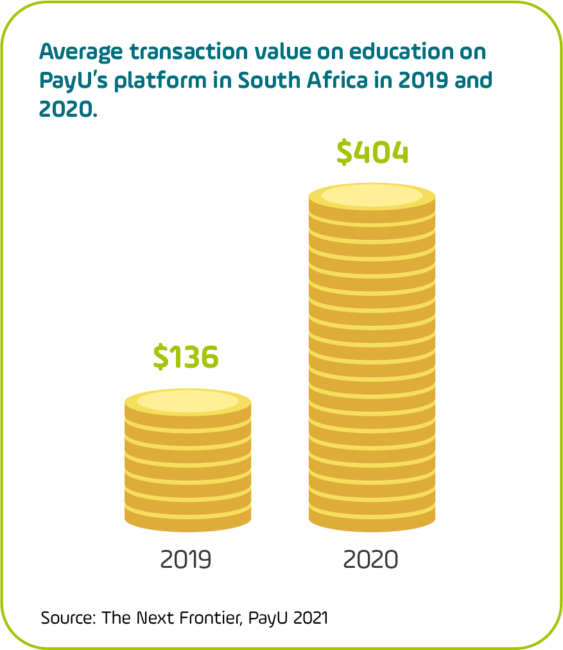

Online courses and learning subscriptions are typically a higher value product, meaning that customers are even more focused on using their payment method of choice for billing. That means that merchants should put at least as much thought into the payment methods they have on offer as they would into pricing and other product-related decisions.

When it comes to expanding in emerging markets, local and alternative payment methods are especially important for adapting the product offering and winning consumer trust. With that said, alternative payments are also becoming increasingly prominent in developed countries, as more customers turn to e-wallets and BNPL grows in market share.

Here are some tips for EdTech and e-learning providers when it comes to building the right payment infrastructure for scaling and market growth:

1. Automate the payment process

A smooth payment process is critical for customer satisfaction. Ideally, payments for e-learning content should be facilitated with minimal additional effort from students.

Recurring payments allow digital education providers to automatically charge learners at specific times, save payment data for the future, and enable users to pay with a single click.

To learn more about PayU’s subscription payment offer, get in touch with our team.

2. Offer more payment methods to meet customers halfway

As with any e-commerce business, e-learning providers need to optimize every area of customer experience – including the checkout process.

By providing multiple global and local payment options, e-learning platforms can improve their conversion rates across domestic and international markets. More payment methods help to increase appeal to a broader audience by ensuring a seamless shopping experience for everyone.

3. Focus on mobile e-commerce

Unsurprisingly, e-learning is particularly popular amongst Millennials and Gen Z. At the same time, these two generations convert via mobile more than other generations.

That’s why optimizing for mobile e-commerce is essential for providers looking to engage these customer segments. With many referrals for online courses coming via LinkedIn, Instagram, and other social media, mobile is particularly important when it comes to customer acquisition.

To boost mobile conversion rates, e-learning businesses should focus on providing a well-optimized payment page design and user-friendly checkout experience regardless of the channel. Being able to offer payment via digital wallets and other mobile-first payment options also adds a layer of convenience that can help to reduce cart abandonments on mobile and drive increased revenue.

4. Develop a local acquiring approach

From the consumer perspective, the payment process ends after the customer inputs their payment details and clicks to pay. But from the perspective of receiving payments, getting a customer through the checkout funnel is just the beginning.

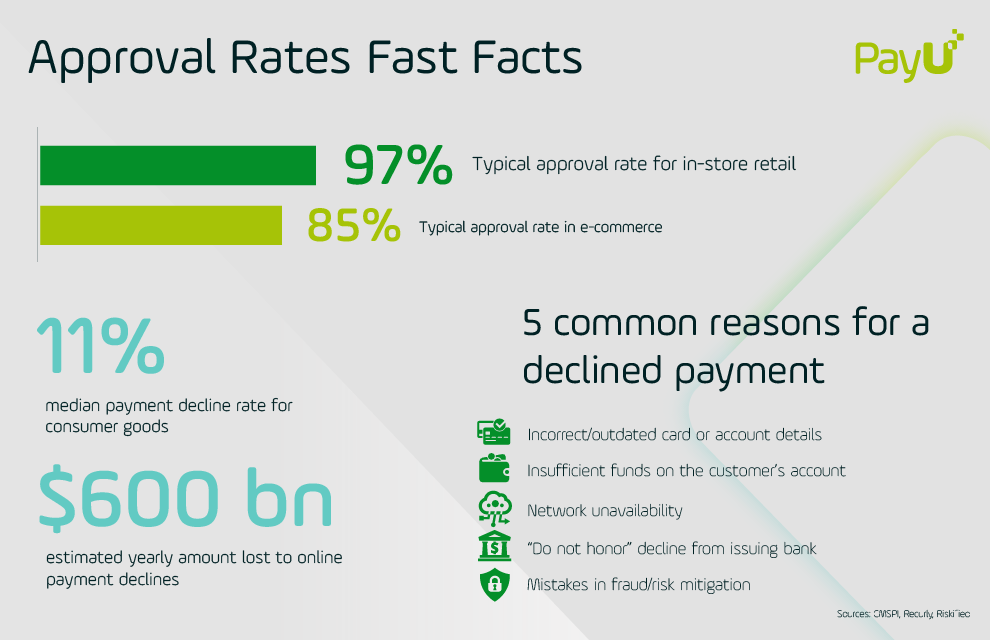

Understanding the complexities of global payments is particularly key in online learning because students, teachers, and e-learning providers may be located in different countries or regions. There are any number of places where a payment can go wrong while it’s being routed through the maze of issuing and acquiring banks, payment processing networks, and payment methods that are required to successfully complete an online payment.

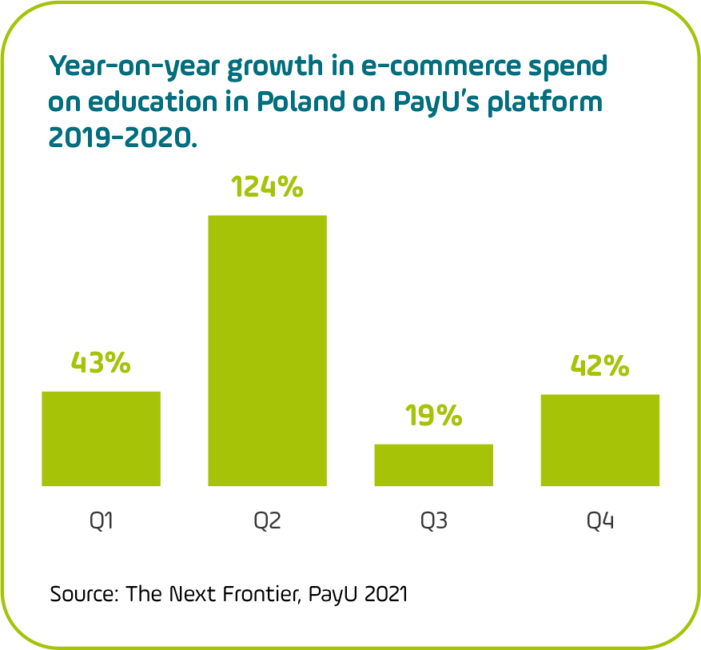

It’s little wonder that while approval rates for brick-and-mortar transactions average over 97%, just 85% of e-commerce transactions are approved at the back end. For a market segment like e-learning that relies completely on online conversions, optimizing payment approval rates can mean the difference between tens or even hundreds of thousands of dollars in potential revenue.

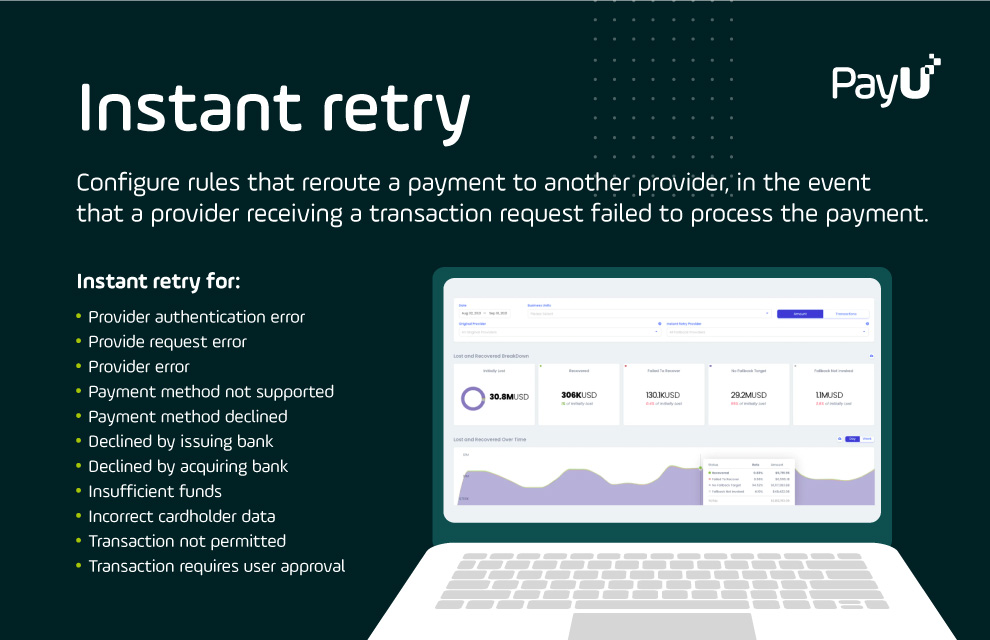

Working with a global payment provider allows merchants to get more payments approved by facilitating transactions via local or regional payment processing networks in the places where a payment is being made. If a transaction doesn’t move along the path to completion smoothly, the global payment platform can forward it through additional processing channels until its successful completion (more on this below).

Payment Solutions

Payment Solutions Services

Services Credit

Credit Resources

Resources About PayU GPO

About PayU GPO