Additional content

Watch our webinar on the importance of local payment methods when it comes to e-commerce in Latin America.

View webinarAcross multiple regions and market sectors, Latin America leads the way in our recent report on e-commerce in 19 of the world’s emerging markets.

From Eastern Europe to Africa, India, Latin America, and Southeast Asia, PayU is active in some of the world’s most dynamic emerging e-commerce markets. So while the explosive growth of e-commerce around the world over the past year might have come faster than expected, it has not come as a surprise.

As COVID-19 continued to turn the business world upside down over the second half of 2020, we began putting together The Next Frontier, a report looking at growth in digitization and e-commerce across 19 emerging markets where we are active. Combining external information with insights from local PayU leaders and data from PayU’s global payments platform, our report looks at the emerging markets which are leading the way in four key e-commerce market verticals.

While 2020 brought significant growth to the e-commerce landscape in multiple emerging markets, one region stands out above the others. Across all four sectors we analyzed – Beauty & Cosmetics, Fashion, Education, and Digital Goods – Latin America showed the strongest and most consistent growth both in external figures as well as primary data from our payment portal.

Despite dealing with political turmoil and several of the world’s most devastating coronavirus outbreaks in 2020, e-commerce in Latin America advanced significantly across a wide range of countries and geographies. Looking ahead, the sector is anchored by two of the world’s largest emerging e-commerce markets (Mexico and Brazil), as well as strong and growing mid-size markets (Argentina and Colombia), South America’s richest economy (Chile), and an up-and-coming digital sector in Peru.

Scroll down to see why it’s never been more exciting to be an e-commerce merchant in Latin America – and fill in the form at the bottom of the page to download our full report.

Over USD $14bn was spent online on fashion alone across Latin America in 2020, according to external data. On PayU platforms, we saw triple digit (191%) growth in year-on-year online consumer spend.

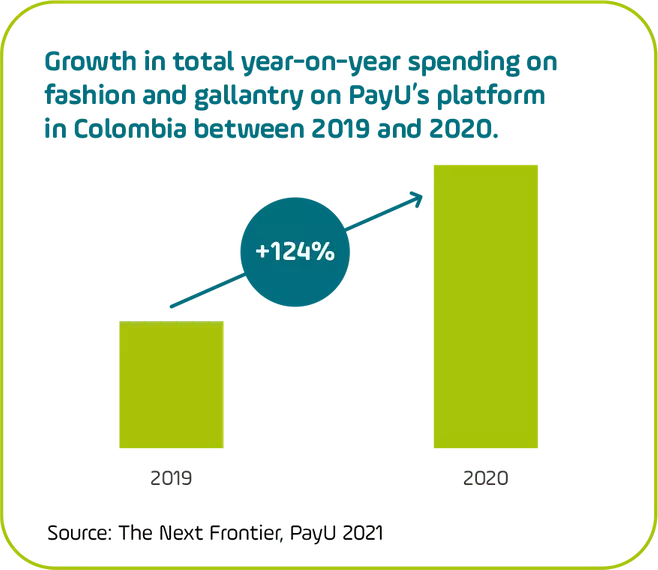

While Colombia didn’t quite see the same massive jumps in activity on our platform as other Latin American e-commerce markets (notably Argentina and Brazil), a more-than-respectable 124% increase in online spend within the fashion vertical showed that plenty of growth still lies ahead for Colombia’s already vibrant e-commerce sector.

Across all four sectors surveyed, Colombia continues to be one of the most reliable and consistent performers when it comes to e-commerce spend. PayU onboarded a notably large number of beauty and cosmetics merchants across Colombia during 2020, helping to drive a 70% increase in sales processed in this sector by our payment platform. At the same time, spending on digital goods and online education offerings increased by 62% and 73%, respectively.

Colombia has long been a key market for PayU, which makes the additional growth seen in 2020 all the more impressive. Strong public sector support for e-commerce continues to play a role: Colombia’s government approved three days of tax-free retail sales in 2020, the latter two of which applied to online sales only.

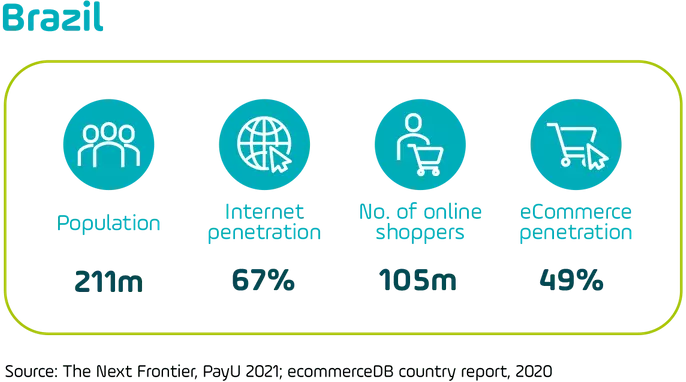

If Latin America is an awakening e-commerce giant, then we must credit Brazil with setting the pace of its growth.

Over the past few years, Brazil has proved itself to be one of the world’s leading emerging markets for global e-commerce merchants. The pandemic accelerated the shift to digital, and we saw online sales grow by more than 50% across the country on our platform.

Cross-border e-commerce accounts for a large share of these sales. In total, cross-border e-commerce is expected to represent 25% of all online sales in Brazil by 2024, a promising sign for international merchants exploring opportunities in Brazilian e-commerce.

PayU’s platform saw notable increases last year in the digital goods (+32%), education (+59% in Q4), and fashion verticals (up a whopping 500% over 2019).

At USD $2.5 billion, Brazil boasted the second-highest projected e-commerce spend on beauty and cosmetics products in 2021, among the 19 countries surveyed in our report. With $3.16 billion in projected spending on digital goods, Brazil also places second worldwide in this category (behind only India in both cases).

PayU is active in 7 Latin American markets, all of which are also seeing strong e-commerce gains.

Of the countries we surveyed, Mexico had the third-highest projected spend on digital goods in 2021 after India and Brazil, at USD $2.1 billion. Mexico’s online education spend on our platform also registered the largest increase in 2020, with gains of 139%. E-commerce fashion spending in Mexico, meanwhile, was higher than Brazil despite Mexico (127 million) having only a little more than half of Brazil’s population (211 million).

When it comes to smaller Latin American markets, Chile and Peru are both interesting countries to watch despite being at opposite ends of the income spectrum. With approximately 19 million people, Chile would be one of the 10 largest countries in Europe by population. The e-commerce market has historically been held back by challenges with logistics as well as low levels of mobile commerce, but the market still shows significant growth potential. Spending on digital goods rose by more than 200% on our payment platform in Chile during 2020.

Peru on the other hand has faced challenges largely with consumer trust, particularly when it comes to digital payments. Cash is still widely used, and a 2019 survey revealed that majorities in Lima and other Peruvian cities stated that they had never purchased anything online because they did not believe they would receive the product they had ordered. As it has in so many places, the necessity of e-commerce during the pandemic has chipped away at the trust issue and succeeded in bringing more Peruvians online.

With the fourth-largest population in South America (33 million), Peru could become a significant e-commerce growth market in the years to come. Across PayU’s seven Latin American markets studied in the Next Frontier report, Peru exceeded the average growth rate in every market sector.

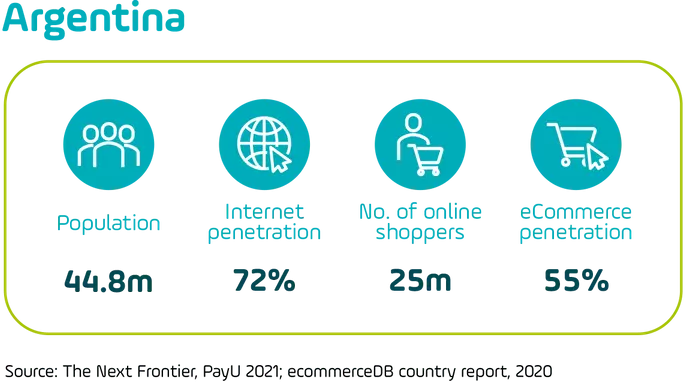

Argentina distinguished itself on our platform in 2020 with massive increases in transaction value across multiple sectors.

Online fashion spend grew last year by 447% on the PayU platform in Argentina, with an average transaction value of USD $108, which was the highest across all of our LatAm markets. In digital goods, meanwhile, Argentina was +131% on our platform, trailing only Chile.

E-commerce has been a bright spot in Argentina since the country’s 2018 economic crisis, the aftermath of which is still being felt today. According to the Argentine Chamber of Electronic Commerce, online business grew 76% during 2019, after growing by 64% in 2018.

Over the past year e-commerce has begun to take hold in more of the country, after previously being mostly confined to Buenos Aires and other large cities. Internet penetration is increasing, mobile users are rising, and more Argentinians are gaining access to financial services, all of which will contribute to continued e-commerce growth in Latin America’s third largest economy over the coming years.

Learn more about the digital landscape in Latin America and other emerging e-commerce markets.

We also provide insights on the local payment ecosystem, leveraging our experience as a leading payment technology platform offering merchants a single global solution for emerging as well as established markets.

Fill in the form to download our report and learn more about e-commerce and local payments in the most exciting growth markets around the world.