-

Payment Solutions

Payment Solutions

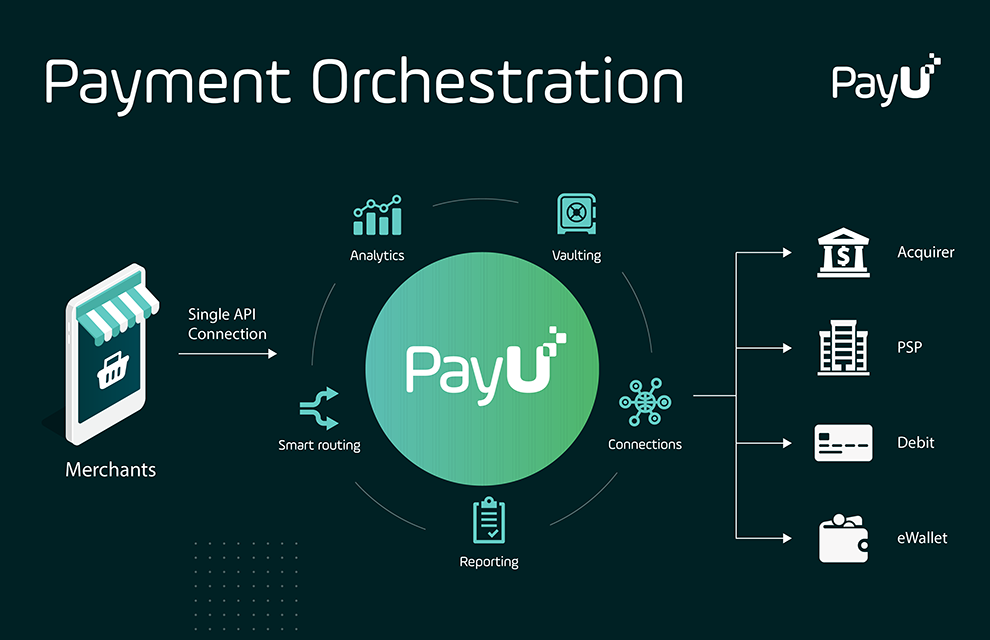

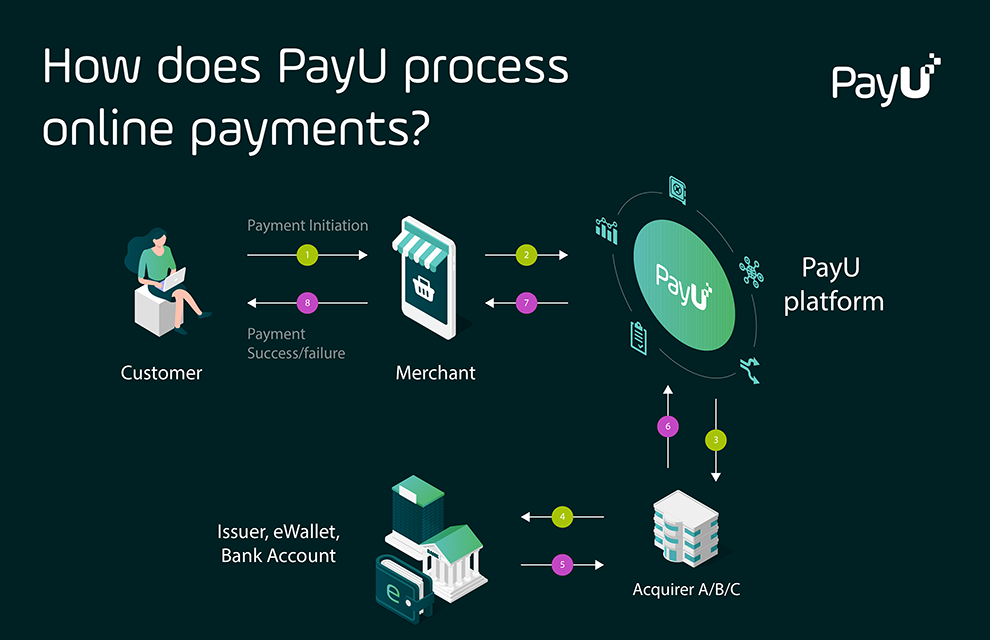

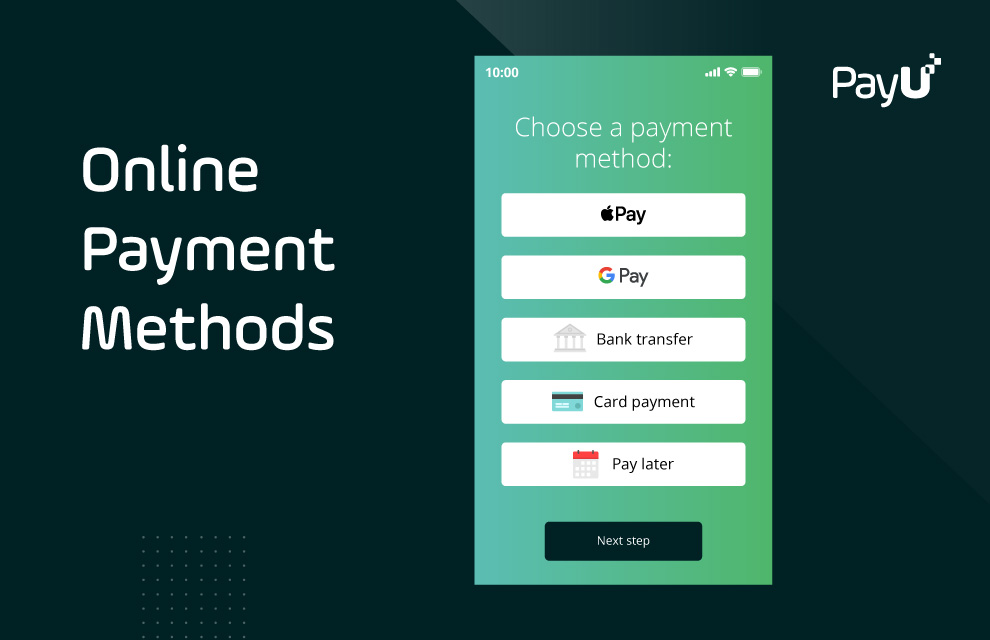

Payment SolutionsPayU’s global payment platform allows merchants to accept payments in CEE, LatAm and Africa, while enabling a wide range of payment optimization and security features via a single API.

- Payment Solutions

PayU’s global payment platform allows merchants to accept payments in CEE, LatAm and Africa, while enabling a wide range of payment optimization and security features via a single API.

-

Services

Services

ServicesDiscover value-added payment services available via PayU, from industry-leading payment security and fraud protection to optimization features for getting the most out of your online payments.

- Services

Discover value-added payment services available via PayU, from industry-leading payment security and fraud protection to optimization features for getting the most out of your online payments.

-

Products

Products

ProductsPayU has a dedicated credit division with multiple products for BNPL and installment payments available around the world.

- Products

PayU has a dedicated credit division with multiple products for BNPL and installment payments available around the world.

-

Industries

Industries

IndustriesPayU provides a wide range of solutions for merchants in specific market verticals, including a dedicated offering for SMBs.

- Industries

PayU provides a wide range of solutions for merchants in specific market verticals, including a dedicated offering for SMBs.

-

Resources

Resources

ResourcesBrowse our blog and knowledge hub to learn more about key topics related to payments, fintech, and financial inclusion in emerging markets.

- Resources

Browse our blog and knowledge hub to learn more about key topics related to payments, fintech, and financial inclusion in emerging markets.

-

About PayU

About PayU

About PayUOperating in over 50 countries and home to more than 43 nationalities, PayU is one of the world’s leaders in global payments and innovative fintech.

- About PayU

Operating in over 50 countries and home to more than 43 nationalities, PayU is one of the world’s leaders in global payments and innovative fintech.

- In your country